Chart(s) Of The Day: What Makes GM Tick

With GM’s IPO officially launched, we thought we’d send ChartOTD diving inside GM’s sales performance this year. The graph above shows GM’s top nameplates by volume for the January-October 2010 period, compared to the same ten months of 2009. All of GM’s top-ten volume vehicles are doing better than they did last year, but these are not in fact GM’s fastest-growing nameplates. For that graph and more, hit the jump…

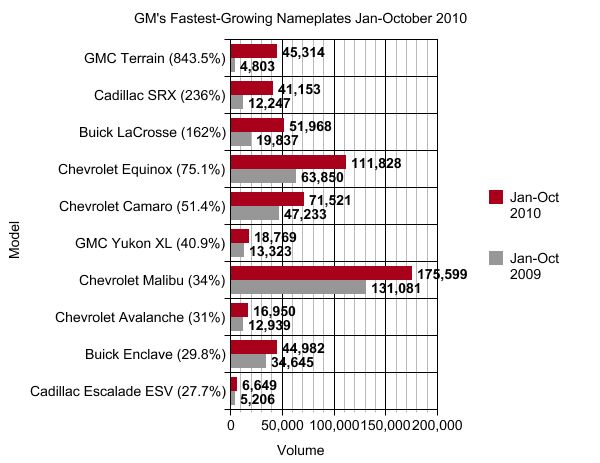

“Fastest growing” is a phrase marketers like because it’s a fairly subjective measure, dependent entirely on the period in which you compare sales and often skewed by production-related interruptions. That’s the case here, as GM’s fastest-growing nameplate, the GMC Terrain, only started started production in August of last year, meaning we’re comparing 10 months worth of sales to two months. Still, the Terrain’s two months of sales in ’09 yielded roughly the same as the GMC Envoy’s first ten months of ’09, so the Terrain gets to keep its “fastest-growing” title.

The obvious conclusion to take from this graph is that new models are yielding big sales in their first several years on the market. The less-obvious lesson: big-volume nameplates aren’t growing all that fast. Still, growth is good… which brings us to the next chart.

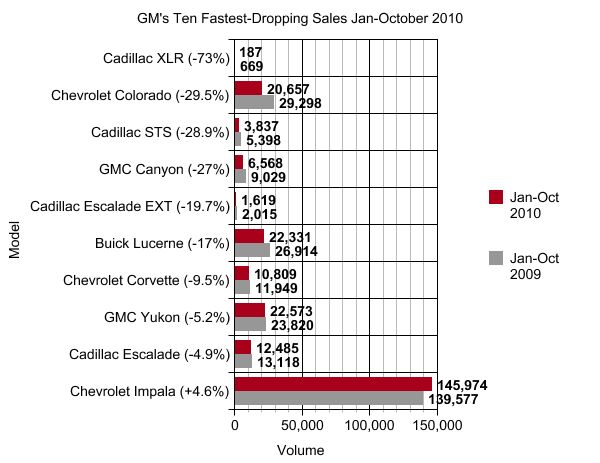

Yes, they’re GM’s fastest-dropping nameplates. The ten deadly sales sins, if you will (incidentally, all of these graphs are based on “core” brands only). Again, ignore the king of the chart, as XLR has always been sold at meaninglessly low volumes. The obvious losers are the Canyon/Colorado twins, for which no update, refresh, or replacement has been announced. Cadillac’s STS (now V8-free for 2011) and Buick’s Lucerne are entering the last months of their lives, while Escalades and Yukons are actually remaining remarkably consistent. GM can be proud that no big-volume nameplates are experiencing negative growth, although the Impala is the slowest-growing nameplate, making it the perfect vehicle to round out the “bottom ten.” The fact that the Impala (like most of the cars on this list) doesn’t have an obvious replacement on the horizon is another worrying sign. GM’s new cars are selling fast, but the new hotness is still stuck next to some old-and-bustedness on the sales lot. If there’s a key to winning the perception game in the auto industry it’s consistency… and GM still isn’t as consistent as it needs to be.

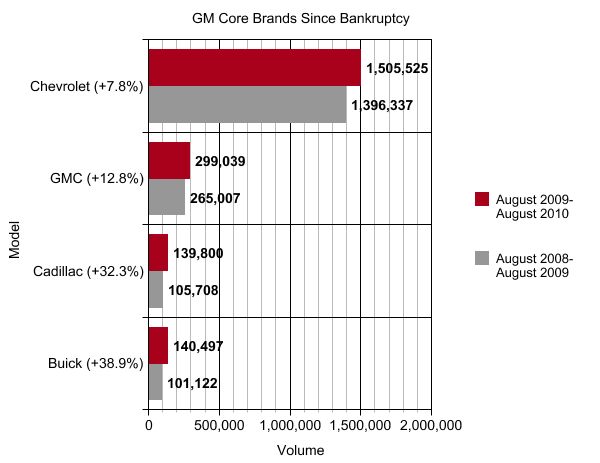

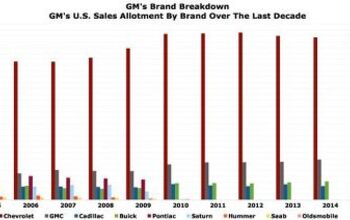

Still, in the first full year of sales post-bankruptcy, GM’s brands enjoyed relatively strong growth. In fact, Buick, Cadillac and GMC have been the three “fastest growing” brands in the American market since GM underwent government-supported bankruptcy.

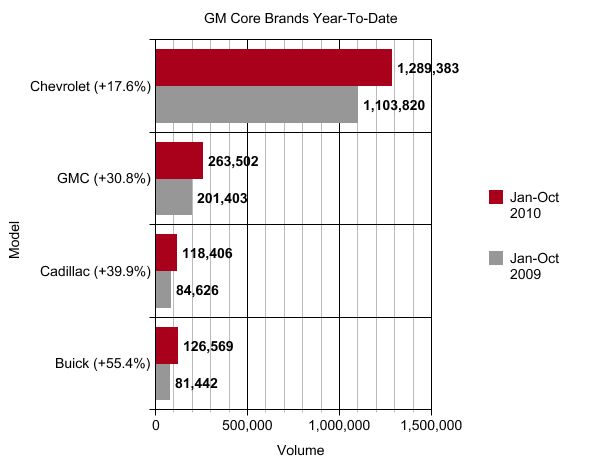

And since January of this year, that growth has only accelerated. Buick is up over 50 percent compared to the first ten months of 2009, making it the fastest growing brand in America this year. Cadillac and GMC are numbers two and three respectively. Even Chevy is outpacing the roughly ten percent market growth, and because of its volume is ten times that of Buick, it’s bringing a lot more volume to The General.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Slavuta I recently was looking at some Toyota parts. I think this ebay user sells totally counterfeit Toyota parts. Check the negative reviews

- Analoggrotto GM under Bob Lutz.

- Aja8888 For that kind of money, you can buy a new 2024 Equinox!

- Ras815 The low-ish combined EPA rating on the hybrid version might be a bit misleading - I'd imagine in a real-world case, you could see a substantial improvement in around-town driving/hauling compared to the gas equivalent.

- Lim65787364 Melissa needs to be get my money back up and for new car payment

Comments

Join the conversation

Just don't blame the Baby Boomers. The repetitive Boomer bashing so commonly seen across the depth and width and sundry other dimensions of the Web (but not hereabouts) is onerous, leading to disgruntlement within a horde of the herd of the Old Coot demographic.