Ford Reports $1.7b Profit For Q3

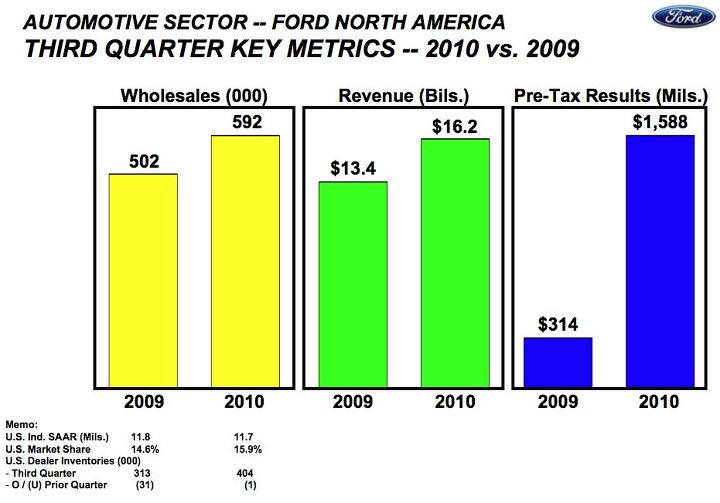

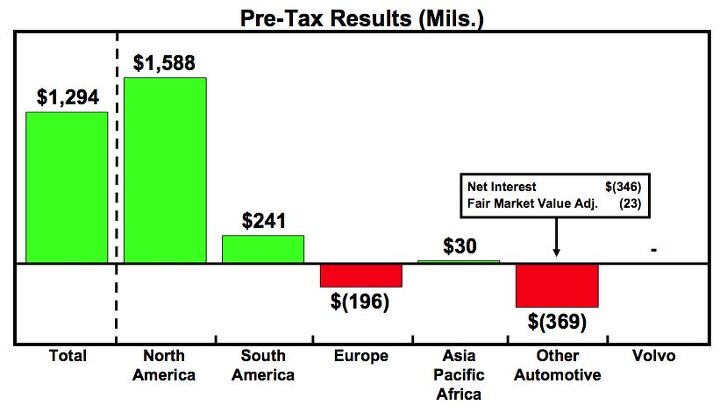

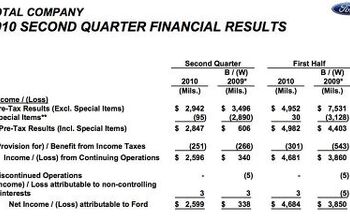

Ford’s profitability outstripped even yesterday‘s $1.37b estimate, coming in at a whopping $1.68b, as Ford made mad money in the North American market in the 3rd Quarter of this year, for a fifth consecutive profitable quarter. Global revenue was down by about $1b, but excluding Volvo from Q33 2009 results, revenue was actually up $1.7b. $1.6b of Ford’s profitability came from North America, as its most crucial market carried the company over weak overseas results. And with $900m in positive cash flow, Ford says its “automotive cash” will equal its debt by the year’s end, sooner than it had previously forecast. Ford paid of $2b of its revolving credit line last quarter, and plans to pay off the final $3.6b it owes the UAW VEBA trust in Q4. By the end of the year, Ford estimates it will have reduced its overall debt by $10.8b over the course of 2010. Hit the jump for a few key slides from Ford’s Q3 financial presentation.

Ford’s complete slide set can be found here in PDF format, but we’ve assembled a few of the most telling slides here.

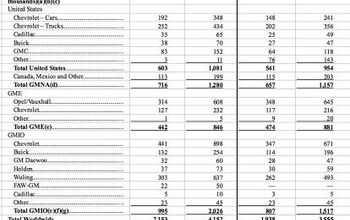

Clearly North America is where it’s happening for Ford.

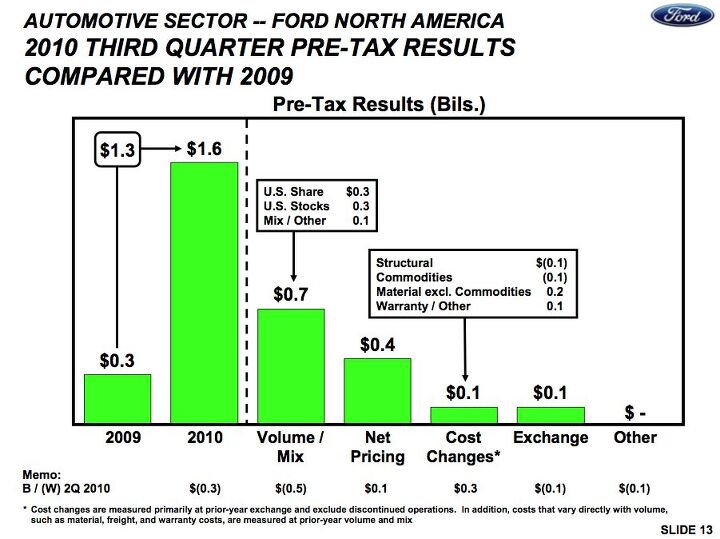

But where is Ford pulling those profits from? Volume and market share are up, and as identified yesterday, Net Pricing is a major contributor. Selling Fiestas for more than the cost of a Corolla is a great way to inflate already-healthy profits. But mix is important as well. Much of Ford’s volume gains have been in profitable trucks, as the F-Series is having one of its better years in some time.

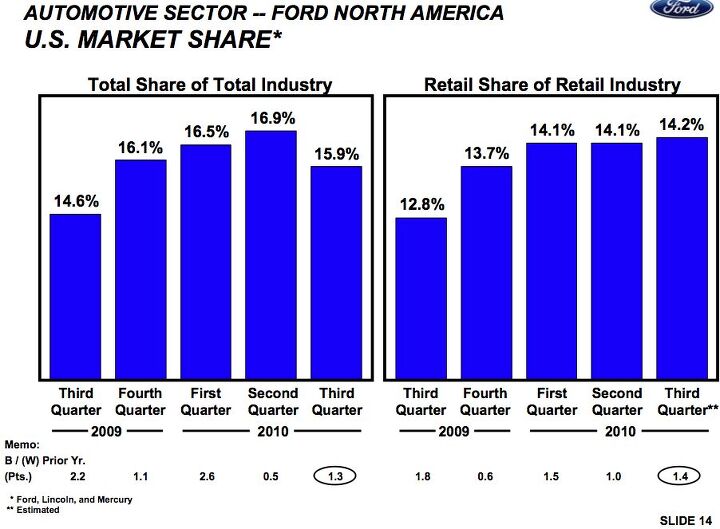

After all, Ford’s North American market share actually declined significantly in the third quarter… but its retail share actually increased. This seems to prove that Ford is getting off the fleet-sales jag that has brought overall sales levels up, and has particularly buoyed the Detroit firms. And why not? Ford is making enough money due to consumers choosing its more profitable products, and by securing better transaction prices for its vehicles. Though Ford ran at 30 percent fleet for most of the year, it hasn’t seemed to hurt demand, and Ford’s proving that it can lay off the “empty calorie” volume and focus on making money.

And making money it is. If Ford can end the year with more cash than debt and keep its sales and pricing momentum up into next year, when key products like the 2012 Focus launch, it will cement the Blue Oval’s status as the Detroit automaker to beat.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kwik_Shift_Pro4X '19 Nissan Frontier @78000 miles has been oil changes ( eng/ diffs/ tranny/ transfer). Still on original brakes and second set of tires.

- ChristianWimmer I have a 2018 Mercedes A250 with almost 80,000 km on the clock and a vintage ‘89 Mercedes 500SL R129 with almost 300,000 km.The A250 has had zero issues but the yearly servicing costs are typically expensive from this brand - as expected. Basic yearly service costs around 400 Euros whereas a more comprehensive servicing with new brake pads, spark plugs plus TÜV etc. is in the 1000+ Euro region.The 500SL servicing costs were expensive when it was serviced at a Benz dealer, but they won’t touch this classic anymore. I have it serviced by a mechanic from another Benz dealership who also owns an R129 300SL-24 and he’ll do basic maintenance on it for a mere 150 Euros. I only drive the 500SL about 2000 km a year so running costs are low although the fuel costs are insane here. The 500SL has had two previous owners with full service history. It’s been a reliable car according to the records. The roof folding mechanism needs so adjusting and oiling from time to time but that’s normal.

- Theflyersfan I wonder how many people recalled these after watching EuroCrash. There's someone one street over that has a similar yellow one of these, and you can tell he loves that car. It was just a tough sell - too expensive, way too heavy, zero passenger space, limited cargo bed, but for a chunk of the population, looked awesome. This was always meant to be a one and done car. Hopefully some are still running 20 years from now so we have a "remember when?" moment with them.

- Lorenzo A friend bought one of these new. Six months later he traded it in for a Chrysler PT Cruiser. He already had a 1998 Corvette, so I thought he just wanted more passenger space. It turned out someone broke into the SSR and stole $1500 of tools, without even breaking the lock. He figured nobody breaks into a PT Cruiser, but he had a custom trunk lock installed.

- Jeff Not bad just oil changes and tire rotations. Most of the recalls on my Maverick have been fixed with programming. Did have to buy 1 new tire for my Maverick got a nail in the sidewall.

Comments

Join the conversation

Used part of my profits from Ford stock to buy a new Mustang Convertible. Win-win. :-)

It seems that the CNN/Money/Fortune Businessperson of the Year voting is coming down to a final round of Alan Mulally vs Steven Jobs. Mulally is crushing Warren Buffett in the semi-final round (95% to 5%). In the previous round Buffett defeated Ratan Tata.