Government Loan Guarantees Help Ford Beat The Debt

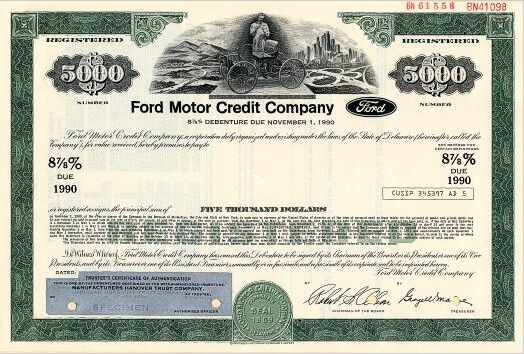

At the end of the second quarter of this year, Ford’s overall automotive debt totaled $25.8 billion. Just three months before, its debt level was at $32.6 billion. The debt reduction is all part of CEO Alan Mulally’s plant to earn an investment-grade debt rating by the end of 2011, a move that will lower Ford’s cost of borrowing as well as lowering interest payments. And though Ford’s been making a healthy profit, America’s bailout-free automaker has had more than its fair share of government help to beat the debt. According to the WSJ [sub], Ford’s extensive collection of government loan guarantees has been key to its ability to pay down more expensive debt accumulated during Ford’s 2006 restructuring.

Last week’s US Export-Import Bank loan of $250m was just the latest in a string of government loan guarantees that have helped Ford cut its debt. THe UK government also recently put a $572m guarantee for a $715m European Investment Bank loan to Ford. The EIB has also promised Ford $527.6m to produce cars in Romania. Ford has also taken on $1.8b in low-cost Department of Energy loans this year, on top of last year’s $5.9b DOE “Section 136” retooling loan. And the help is working

In April [Ford] made a $3 billion pre-payment on a $7.5 billion revolving loan.

In June, it paid $3.8 billion in cash to the United Auto Workers Retiree Medical Benefits Trust. A large chunk of the payment for retired worker health-care benefits was paid ahead of schedule.

Ford said its total debt payment in the second quarter should yield annual interest savings of more than $470 million.

Despite the EIB’s rejection of another $264m loan, Ford is clearing its bad debt with remarkable speed, a fact that was rewarded last week when Fitch raised Ford’s debt rating to within three steps of an investment-grade rating. Doubtless Ford would have been prioritizing debt reduction regardless of its government help, and it’s certainly made enough profit this year to make a start on the task. Thanks to generous government assistance, however, Ford is blowing through its debt faster than previously imagined.

In the second quarter of this year, Ford paid an estimated $318 per vehicle produced just to pay interest on its debt. Ford now estimates its total annual savings due to second-quarter debt reductions of more than $470m. And thus far consumers continue to see Ford as having avoided a bailout. Talk about having your cake and eating it too.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC "That’s expensive for a midsize pickup" All of the "offroad" midsize trucks fall in that 65k USD range. The ZR2 is probably the cheapest ( without Bison option).

- Lou_BC There are a few in my town. They come out on sunny days. I'd rather spend $29k on a square body Chevy

- Lou_BC I had a 2010 Ford F150 and 2010 Toyota Sienna. The F150 went through 3 sets of brakes and Sienna 2 sets. Similar mileage and 10 year span.4 sets tires on F150. Truck needed a set of rear shocks and front axle seals. The solenoid in the T-case was replaced under warranty. I replaced a "blend door motor" on heater. Sienna needed a water pump and heater blower both on warranty. One TSB then recall on spare tire cable. Has a limp mode due to an engine sensor failure. At 11 years old I had to replace clutch pack in rear diff F150. My ZR2 diesel at 55,000 km. Needs new tires. Duratrac's worn and chewed up. Needed front end alignment (1st time ever on any truck I've owned).Rear brakes worn out. Left pads were to metal. Chevy rear brakes don't like offroad. Weird "inside out" dents in a few spots rear fenders. Typically GM can't really build an offroad truck issue. They won't warranty. Has fender-well liners. Tore off one rear shock protector. Was cheaper to order from GM warehouse through parts supplier than through Chevy dealer. Lots of squeaks and rattles. Infotainment has crashed a few times. Seat heater modual was on recall. One of those post sale retrofit.Local dealer is horrific. If my son can't service or repair it, I'll drive 120 km to the next town. 1st and last Chevy. Love the drivetrain and suspension. Fit and finish mediocre. Dealer sucks.

- MaintenanceCosts You expect everything on Amazon and eBay to be fake, but it's a shame to see fake stuff on Summit Racing. Glad they pulled it.

- SCE to AUX 08 Rabbit (college car, 128k miles): Everything is expensive and difficult to repair. Bought it several years ago as a favor to a friend leaving the country. I outsourced the clutch ($1200), but I did all other work. Ignition switch, all calipers, pads, rotors, A/C compressor, blower fan, cooling fan, plugs and coils, belts and tensioners, 3 flat tires (nails), and on and on.19 Ioniq EV (66k miles): 12V battery, wipers, 1 set of tires, cabin air filter, new pads and rotors at 15k miles since the factory ones wore funny, 1 qt of reduction gear oil. Insurance is cheap. It costs me nearly nothing to drive it.22 Santa Fe (22k miles): Nothing yet, except oil changes. I dread having to buy tires.

Comments

Join the conversation

I sure wouldn't mind being able to pay off my mortgage with a low-interest, government-backed loan...

Ford has taken advantage of low interest loans that are available to any qualifying business. If you have to consider tax savings or gov’t subsidies for a deal to turn a profit then it isn’t a great deal to begin with. online car insurance quote