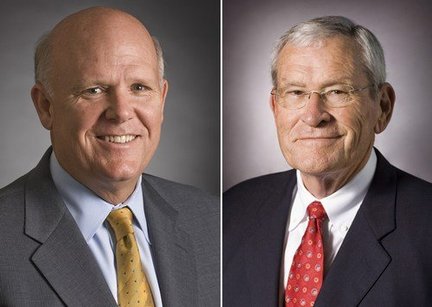

GM Board Pushed Whitacre Out For IPO

From the moment GM’s Chairman Ed Whitacre took over for Fritz Henderson as CEO, many wondered how long the 68-year-old Texan would stick around. Apparently GM’s board was not immune from such uncertainty either, as Bloomberg reports that it gave Whitacre an ultimatum: commit to the long haul or get out now. According to reports, several Wall Street banks asked Whitacre whether he would be leading GM long-term during pre-IPO meetings. Whitacre didn’t answer at the time, but the pressure from Wall Street clearly pressed the board’s hand. Since Whitacre ultimately didn’t want to stick around for an extended term (posibly due to the Treasury’s unwillingness to dump all of its stock during GM’s IPO), the board picked Dan Akerson to take over. But how will an unexpected handoff to an unknown executive with no industry experience affect GM’s IPO?

This is not a planned succession as it’s being spun. This is not the way it’s done with an IPO. The IPO should be delayed until GM gives the full story behind the leadership change.

There are also concerns from the businesses that rely on GM. After Ed Whitacre axed a number of established GM executives (including his CEO predecessor Fritz Henderson), Whitacre was the one consistent figure in GM… with his departure, at least one supplier company executive is worried, saying

I thought what they needed right now was stability at the executive level. From our perspective, hopefully it’s the same, the overall structure doesn’t change.

But once again, the government has stayed hands-off on the decision despite the fact that it could severely hurt investor optimism going into the IPO. Treasury was reportedly informed of leadership change on August 10 (the day the decision was made) but had no input in the decision. Like the decision to leave the Volt in place, the government was so anxious to not be perceived as meddling in GM’s day-to-day decisions that it allowed a questionable bit of strategy to play out. Less intervention is good, but with tens of billions of taxpayer dollars riding on the IPO, tolerating GM’s decision to put an unproven leader in the saddle shows perhaps too much respect for GM’s corporate culture.

And the cultural impacts of Akerson’s appointment might well be his most lasting impact. After all, the board clearly feels confident enough in GM’s position to allow an unknown quantity to take over. This sense of satisfaction with GM’s curent position belies the overseas chaos, unfunded pension obligations, and troubled new product plans that GM must vigorously address over the next three years. For a company with a long history of cultural complacency, the fact that GM is trying to brush these inescapable challenges under the rug until after the IPO, while promoting an untested place-holder CEO, is highly troubling.

But, according to the Freep, Akerson is what the board thinks Wall Street wants in a GM executive: a Wall Street guy lots of Wall Street connections. This indicates that Akerson might merely be a placeholder as well, shepherding GM through an IPO until either Mark Reuss or Chris Liddell is ready to take over. Another theory is that Chinese firms or private equity might want to make a play for GM, and Akerson’s corporate buyout experience will help ease such a a deal along. But one thing is for certain: few observers expect Akerson to lead GM into a long period of innovation and change. The real question is whether he’ll have the confidence and authority to prevent complacency from once again infecting GM’s corporate culture.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ltcmgm78 Imagine the feeling of fulfillment he must have when he looks upon all the improvements to the Corvette over time!

- ToolGuy "The car is the eye in my head and I have never spared money on it, no less, it is not new and is over 30 years old."• Translation please?(Theories: written by AI; written by an engineer lol)

- Ltcmgm78 It depends on whether or not the union is a help or a hindrance to the manufacturer and workers. A union isn't needed if the manufacturer takes care of its workers.

- Honda1 Unions were needed back in the early days, not needed know. There are plenty of rules and regulations and government agencies that keep companies in line. It's just a money grad and nothing more. Fain is a punk!

- 1995 SC If the necessary number of employees vote to unionize then yes, they should be unionized. That's how it works.

Comments

Join the conversation

things are going to be just fine at General Motors, believe me.

"There has to be this pioneer, the individual who has the courage, the ambition to overcome the obstacles that always develop when one tries to do something worthwhile, especially when it is new and different." Alfred P. Sloan