Chrysler Loses $172m In Q2

Chrysler recorded another small quarterly loss this quarter, as increased expenditures wiped out modest gains in revenues and earnings. Press release in PDF here, webcast presentation slides in PDF here. More analysis after the jump.

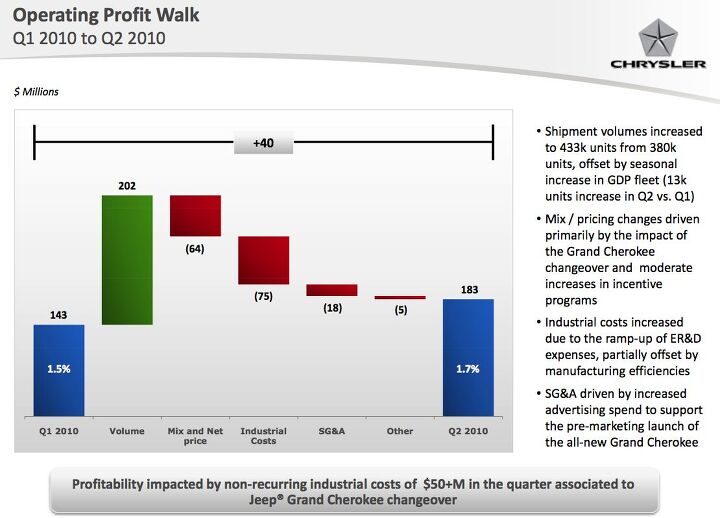

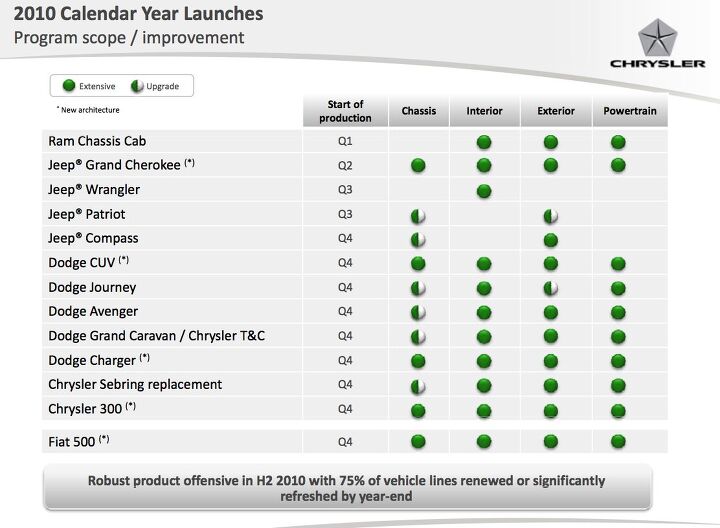

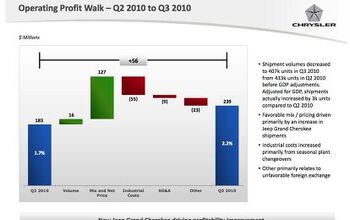

Operating profit was hurt by $50m+ in “non-recurring industrial costs associated with the Jeep Grand Cherokee changeover.” CEO Sergio Marchionne admitted that marketing for the JGC launch was not perfect, and that inefficiencies had hurt financial performance. Furthermore, he said Chrysler’s coming raft of new and refreshed product launches would continue to create inefficiencies leading to similar losses, but that expertise gleaned from the JGC launch would help keep those losses to less than $50m per vehicle launch. But as the next slide shows, even if those costs are contained to the extent Marchionne foresees, the sheer volume of new launches will continue to hurt Chrysler’s performance. Also affecting Chrysler’s volume was a “seasonal” uptick in GDP fleet sales, which could hurt performance on an evenly-distributed basis, as large numbers of operating lease vehicles could be returned with diminished residual values (which, being guaranteed by Chrysler, could have losses associated with them upon return).

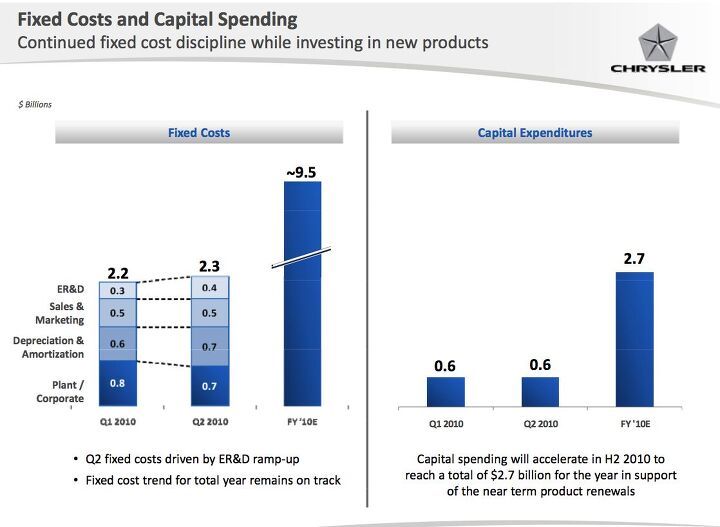

Marchionne admitted that vehicle margins “reflect the age of our product portfolio,” and said that Chrysler’s true performance (or, as Marchionne put it, “the almighty truth”) will not be clear until Q1 of 2011, when most of Chrysler’s new products will have been launched. In the meantime, Marchionne warns against expecting huge capital generation in the second half, as launch costs and increased R&D spend eat into the company’s $10b-ish of liquidity (including remaining government funds). Until then, Marchionne says Chrysler will “continue to concentrate on our cost structure.”

Marchionne did make the point that, although the Grand Cherokee launch was marred by cost overruns, the vehicle was extremely important as a profit center. He said the nameplate was “second to the pickups” in terms of profit margin, and that 2011 combined volume of Grand Cherokee and its unnamed Dodge sister model would range between 200k and 300k units for 2011. But, he warned, “we have to execute on other new models as well.”

Plant/corporate fixed-cost spending went down in Q2, a result of Marchionne’s focus on cost structure. Sales and marketing spend remained flat, but R&D and Depreciation and Amortization costs increased, as Chrysler preps new models for launch. R&D is expected to increase in the second half by at least $300m over H1’s $1.2b number.

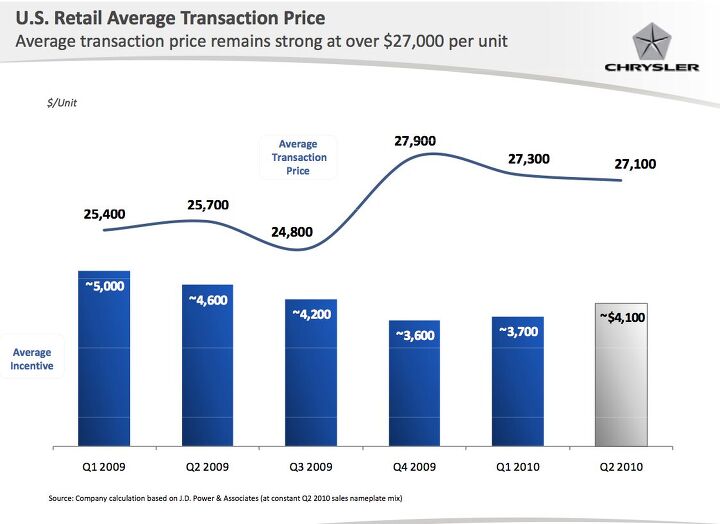

Chrysler’s transaction prices have actually dipped slightly from Q4 2009, while incentive costs have grown. Though the company is still a long way from its $21,100 average transaction price net of incentives in Q2 of last year, pricing performance has certainly dipped in the first half of this year. Again, Marchionne points to the age of Chrysler’s products as the culprit. Dealer inventory volume has remained consistent, rising relative to last summer, but failing to top the 60 days supply level.

In short, Chrysler is operating with extreme discipline as it launches the products that must loft its 2011 sales volume to over 2.2m units. The biggest surprise for Q2 was the unexpected “$50m+” cost related to the Jeep Grand Cherokee launch, which reveals that Chrysler still has a steep learning curve in front of it. Marchionne claims that lessons learned from that launch will help reduce costs with future launches, but he essentially admitted that Chrysler was re-learning how to launch new cars. Given how many new products will be launched over the remainder of 2010, analysts can’t help but worry about launch costs, and their role in Chrysler’s turnaround.

Chrysler refused to break out its fleet sales, and Marchionne launched a vigorous defense of fleet volume, accusing the industry publication Automotive News of a vendetta against fleet sales. Marchionne insists that fleet business “is not dirty” but refused to break with Detroit precedent of not revealing fleet volume. Given that Chrysler already struggles to turn operating profits into net gains, however, losses on lease returns and other residual value-related costs have to be a concern.

But despite sluggish sales (even fueled by incentives and and fleet business) Chrysler has managed its cash well, and now has $7.8b in cash and about $10b in available liquidity. Gross industrial debt was up slightly, but most of that matures after 2015, giving Chrysler a good window for a turnaround.

Ultimately, Chrysler is on the cusp of a major transition, as its new models roll out over the next half-year. Controlling launch costs will be the key challenge, but losses over the next half-year might even be worth it if each dollar truly improves the long-term performance of the relaunched models. If those new models fail to perform, Chrysler’s turnaround will be DOA… and keeping short-term costs down won’t make a lick of difference of these products don’t take off. Meanwhile, incentives and fleet mix will all have to come down on the strength of these new models, even as volume goes up. If there are signs of these trends in Chrysler’s Q1 2011 performance, the firm’s planned IPO next year could have some success. Unfortunately, Marchionne seems far more interested in cashing out the VEBA stake in his firm than making taxpayers whole.

1.6m-1.65m volume is the most important metric, not market share.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Calrson Fan Jeff - Agree with what you said. I think currently an EV pick-up could work in a commercial/fleet application. As someone on this site stated, w/current tech. battery vehicles just do not scale well. EBFlex - No one wanted to hate the Cyber Truck more than me but I can't ignore all the new technology and innovative thinking that went into it. There is a lot I like about it. GM, Ford & Ram should incorporate some it's design cues into their ICE trucks.

- Michael S6 Very confusing if the move is permanent or temporary.

- Jrhurren Worked in Detroit 18 years, live 20 minutes away. Ren Cen is a gem, but a very terrible design inside. I’m surprised GM stuck it out as long as they did there.

- Carson D I thought that this was going to be a comparison of BFGoodrich's different truck tires.

- Tassos Jong-iL North Korea is saving pokemon cards and amibos to buy GM in 10 years, we hope.

Comments

Join the conversation

If Fleet sales aren't "dirty", then there should be no stigma in revealing them.

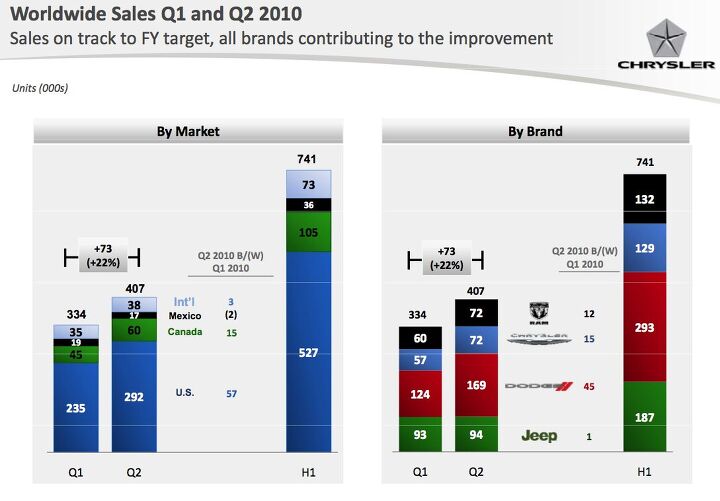

"Chrysler’s worldwide sales were up 22 percent over the first quarter, and US-market sales were up 25 percent, outperforming the market by five percent. Net revenue climbed to $10.478b from $9.687b in Q1" Unit sales up 22% and revenue is up less than 10%, while ATPs are basically flat - how does that work?