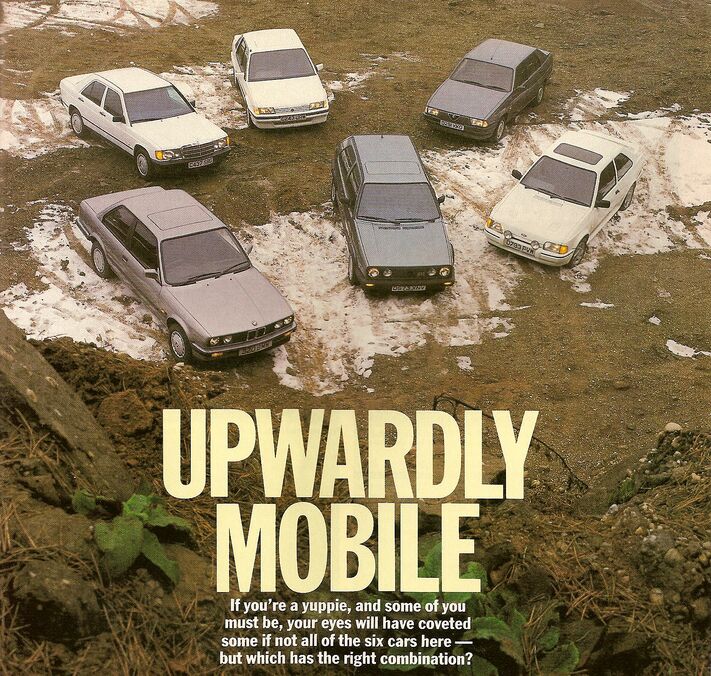

New Or Used: How To Be A Yuppie For $20k Or Less Edition

John writes:

Long time listener, first time caller. I find myself in the yuppie’s dilemma – $18k to spend and infinite possibilities.

Some background: I’ve always loved a great ride and I’ve been promiscuous….my last five cars have been a 1991 535i, a Nissan 200SX, Mazda Millenia, 1997 740il, and I currently drive a 2008 Subaru WRX under lease ($260 a month with $0 down, about the only time a lease has ever made sense to me). When the lease is up, so is the jig. I’m a newly minted lawyer at a large law firm making way more money than I should at 27, and my wife’s a nurse doing just the same. We want to keep the purchase under $20K and I’ve seriously toyed with everything from a 2011 Sonata to a Z3 to 530xi to an A8 and everything in between.

Sajeev Answers:

No, I won’t suggest a Lexus to anyone who enjoys a performance machine. But do you want German, expecting to “take it to 150k without too much out of pocket?” European cost of ownership aside, yuppies like you must appreciate the near extinction of a breed: elegant sedan, RWD, manual transmission, and a host of high tech gadgets. It’s snobbery at the pistonhead level…

…and the G35 fits the bill. While not exactly a BMW, find one with the sport package to put down 3-series numbers without the 3-series repair bills. If it’s not making the grade, upgrade the dampers and (anti) sway bars. A couple of mild aftermarket upgrades is gets you what you want, without paying the ultimate (driving machine) price.

Steve Retorts:

You’re not a Yuppie. You’re barely a ‘Yup!’. Oh and you’re a lucky dude given that real estate prices and interest rates are lower than dirt. Speaking of which…

I wouldn’t sink any money into a car until you saved 20% down for a house. Yeah, I know that this site is all about enjoying the hedonistic wheels du jour but consider this. You have gone through five cars in less than ten years. That’s a piss poor track record when it comes to ‘keeping’ and you’ve already had some good rides. 2 BMW’s. A Subaru WRX. I’m sure that whatever aspiring Yuppie car you get is going to become the flavor of the month in no more than a few years.

So instead of buying based on emotion and the resulting five figured depreciation, I would go the exact opposite way. I would buy something that is affordable, reliable, and will enable you to focus on building a successful career with a six figured savings account to boot. I would see if anyone in the family is going to be trading in anything that can simply get you from A to B with a fair bit of comfort and safety.

A well-kept $10,000 car can easily last another 10 years if you change your driving style ‘dramatically’ and keep up with the maintenance. You may need to lighten up on the pedal given that WRX’s and BMW’s encourage FU driving, But when you work those long hours at Dewey Cheetham & Howe, you’re really going to want a soothing worry free car over a ‘German’ one.

If you keep the money saved and invested, the two of you will likely be able to buy your own place in less than five years and potentially do whatever the heck you want before you’re 40. Of course there’s kids, and vacations, and a lot of potential career turns. But the big point is that this is the time where you will be able to maximize your savings. That will give you the freedom to do whatever you want in the long-term. Even if that means getting a Ferrari.

By the way, you’re not Yuppies. You’re DINK’s. The overwhelming majority of what most couples save comes during the pre-kid stage. Since both of you are strong earners, I would pursue some financial freedom now instead of opting for Bimmer number 3.

Need help with a car buying conundrum? Email your particulars to mehta@ttac.com, and let TTAC’s collective wisdom make the decision easier… or possibly much, much harder.

More by Sajeev Mehta and Steve Lang

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC Maybe if I ever buy a new car or CUV

- Lou_BC How about telling China and Mexico, we'll accept 1 EV for every illegal you take off our hands ;)

- Analoggrotto The original Tassos was likely conceived in one of these.

- Lorenzo The unspoken killer is that batteries can't be repaired after a fender-bender and the cars are totaled by insurance companies. Very quickly, insurance premiums will be bigger than the the monthly payment, killing all sales. People will be snapping up all the clunkers Tim Healey can find.

- Lorenzo Massachusetts - with the start/finish line at the tip of Cape Cod.

Comments

Join the conversation

I agree with Steve. Check out Dave Ramsey and take the Financial Peace University course he offers. There are great examples of how well off you could be in just ten years with a proper savings (investment) plan.

A 911,preferably a 993. They´re reliable and cool.