Detroit Tops May Incentives, Residuals Rise Regardless

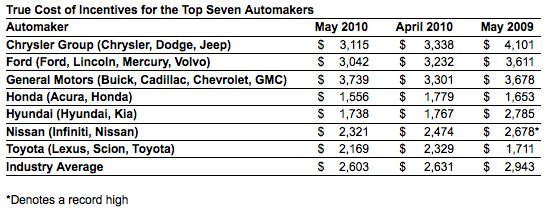

Once again Detroit finds itself atop Edmunds’ True Cost of Incentive ranking of the top seven automakers [via earthtimes], as the domestic OEMs spent about $1.7b (or, about 60 percent) of the $2.8b paid out by the entire industry on incentives last month. Trucks were the most heavily discounted segment, with average incentives running around $4,650, or nearly 13 percent of the average segment sticker price. Saab spent the most by brand, slapping an average of $6,813 on its vehicles, with Lincoln coming in second at $4,987 per vehicle sold. Saab’s incentives equaled 17.1 percent of its average vehicle price, while Chrysler gave away about 12.2 percent of its average vehicle price last month.

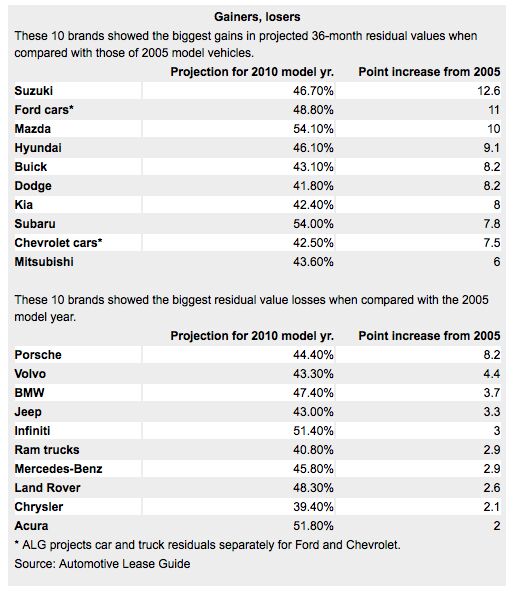

Despite giving away more of their vehicles’ value than the foreign competition, Detroit has some surprisingly good news on the resale value front. Well, Ford and GM, anyway, and really, the resale news couldn’t have been much worse. According to Automotive News [sub]:

Automotive Lease Guide projects that 2010 vehicles from continuing GM brands and 2010 Ford brand cars will retain more than 40 percent of their sticker prices after 36 months. Five years ago, the residual forecasts for those brands’ cars except Cadillac were under 40 percent.

So, considering that Toyota and Honda enjoy about 51 and 54 percent of their original value after 36 months respectively, that’s not exactly break-out-the-champagne news… but it could have been worse. It could have been Chrysler:

Chrysler brand 2010 vehicles, in aggregate, have the industry’s lowest projected residual among continuing brands at 39.4 percent after 36 months, 2.1 percentage points lower than its 2005 projection. But the aggregate residual value for Chrysler Group’s Dodge brand is up a dramatic 8.2 percentage points to 41.8 percent. This does not include Ram brand trucks.

Ay Caramba! Needless to say, both Ford and GM’s resale value improvement (and Chrysler’s lack thereof) is largely attributed to new product. According to ALG’s chief economist:

All new models always have a price bump. The average is a 7 or 8 percentage-point bump for an all-new model compared with the old one

Lower inventories aren’t hurting either, and Edmunds is projecting that late-summer incentives won’t reach their typically fire-sale-like levels because automakers simply don’t have the inventories to shift. But as Detroit makes a slow comeback on resale, other firms are charging ahead. And until incentive discipline on the ground matches the tough talk of sales and marketing execs, these minor gains based on product cadence won’t be enough to keep up with the competition. After all, the three-year resale on a Chevy car is only .10 percent better than a Kia. The work is not over.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ltcmgm78 Imagine the feeling of fulfillment he must have when he looks upon all the improvements to the Corvette over time!

- ToolGuy "The car is the eye in my head and I have never spared money on it, no less, it is not new and is over 30 years old."• Translation please?(Theories: written by AI; written by an engineer lol)

- Ltcmgm78 It depends on whether or not the union is a help or a hindrance to the manufacturer and workers. A union isn't needed if the manufacturer takes care of its workers.

- Honda1 Unions were needed back in the early days, not needed know. There are plenty of rules and regulations and government agencies that keep companies in line. It's just a money grad and nothing more. Fain is a punk!

- 1995 SC If the necessary number of employees vote to unionize then yes, they should be unionized. That's how it works.

Comments

Join the conversation

The trends in the incentives (2010 vs. 2009)are interesting: -Hyundai has slashed theirs, but Chrysler's are down considerably too. -Toyota's have increased significantly, while GM's is virtually flat. Plus, I wonder why Mazda has the highest projected residual value?

Interesting that Chrysler had such a good month with incentives only $500 (or about 20%) over industry average in incentives. This is not much over Ford's position. GM is about $1100 (or over 40%) above the industry's incentive average. As stale as Chrysler's current lineup is, and as fresh as GM's is, I would be a bit concerned if I were Ed Whitacre.