What's Wrong With This Picture: Follow The Incentives Edition

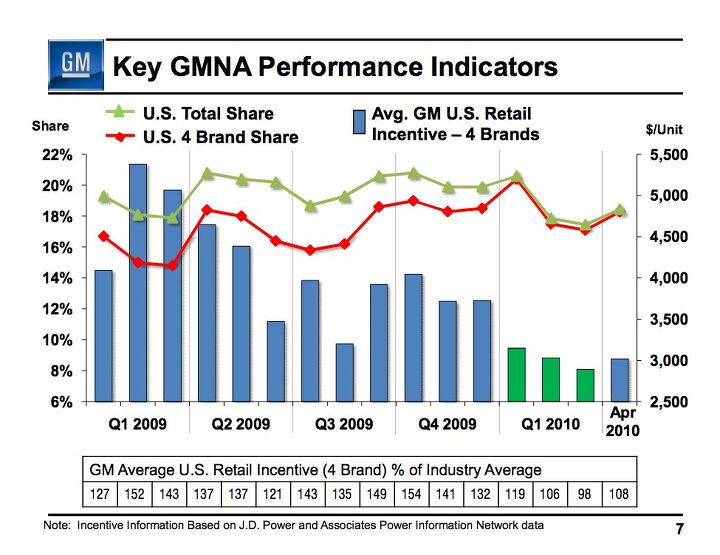

Sadly, my internet came crashing around my ears just as GM’s Q1 results conference call was getting interesting. Typical Monday. I’ll rock myself to sleep tonight with a recording of the call and report back tomorrow, but at this point the big news is plainly visible on this single slide. Yes, GM finally got control of its incentives and wrestled them below the industry average… for a month. That month (March) also just happened to be the worst month this year for GM market-share wise. The next month (April), the incentives went back over the industry average, and market share increased once again. The lesson seems obvious: GM won’t gain market share on promises of high-quality cars and taxpayer payback alone.

Though GM’s executives seem to understand that “buying market share” isn’t worth the long-term downsides, they also don’t appear to have much choice. This, in a nutshell, is why GM is returning to captive lending: it has to buy the market share somehow, and risky loans are better than huge incentives. Problem is, this also proves why the bailout of GM was a foolhardy proposition. In order to sustainably grow their business, automakers need one commodity above all others: the trust and respect of consumers. Without that, you can screw bondholders, force worker concessions, cut dealerships, absolve debt and dump cash on the problem ’till the cows come home, but you’ll still end up with a chart like this.

When analysts say that GM’s new marketing wunderkind Joel Ewanick faces “the toughest job in marketing history,” this is exactly the problem they’re referring to. How he will be able to reverse GM’s spiff dependence, and get people to buy GM products because they want them more than anyone else’s vehicles isn’t the least bit clear at this point. And if he doesn’t make that change, GM will have no choice but to keep the incentives high and pile on the in-house financing giveaways. High stakes indeed, for a problem that Ewanick’s predecessor seemed to think could be solved with the tagline “Excellence For Everyone.”

[GM’s Q1 Slideshow is available in PDF format here, Supplemental information in PDF format here, and Q1 SEC 10-Q filing in PDF format here

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Formula m How many Hyundai and Kia’s do not have the original engine block it left the factory with 10yrs prior?

- 1995 SC I will say that year 29 has been a little spendy on my car (Motor Mounts, Injectors and a Supercharger Service since it had to come off for the injectors, ABS Pump and the tool to cycle the valves to bleed the system, Front Calipers, rear pinion seal, transmission service with a new pan that has a drain, a gaggle of capacitors to fix the ride control module and a replacement amplifier for the stereo. Still needs an exhaust manifold gasket. The front end got serviced in year 28. On the plus side blank cassettes are increasingly easy to find so I have a solid collection of 90 minute playlists.

- MaintenanceCosts My own experiences with, well, maintenance costs:Chevy Bolt, ownership from new to 4.5 years, ~$400*Toyota Highlander Hybrid, ownership from 3.5 to 8 years, ~$2400BMW 335i Convertible, ownership from 11.5 to 13 years, ~$1200Acura Legend, ownership from 20 to 29 years, ~$11,500***Includes a new 12V battery and a set of wiper blades. In fairness, bigger bills for coolant and tire replacement are coming in year 5.**Includes replacement of all rubber parts, rebuild of entire suspension and steering system, and conversion of car to OEM 16" wheel set, among other things

- Jeff Tesla should not be allowed to call its system Full Self-Driving. Very dangerous and misleading.

- Slavuta America, the evil totalitarian police state

Comments

Join the conversation

This seems like good news. It is plain to see that market share is sort of flat, while incentives have trended downward. Call 'em as you see 'em Edward, but don't forget to keep an open mind. Things do change.

Wagoner refused to allow this to be distributed at the shareholders' meeting. time has come perhaps? another look at least... we may not agree 100% (that's probably a good thing) but this could be the plan upon which we build. odds are Reuss and company are following these threads. this is our chance to get together, the B&B @ TTAC. yeah there are other sites, but this is the best, at least my fav for sure. we give it to 'em straight...'cause we care. http://generalwatch.com/editorials/editorial.cfm?EdID=2 your thoughts?