Obama: Dealer Finance Must Be Regulated

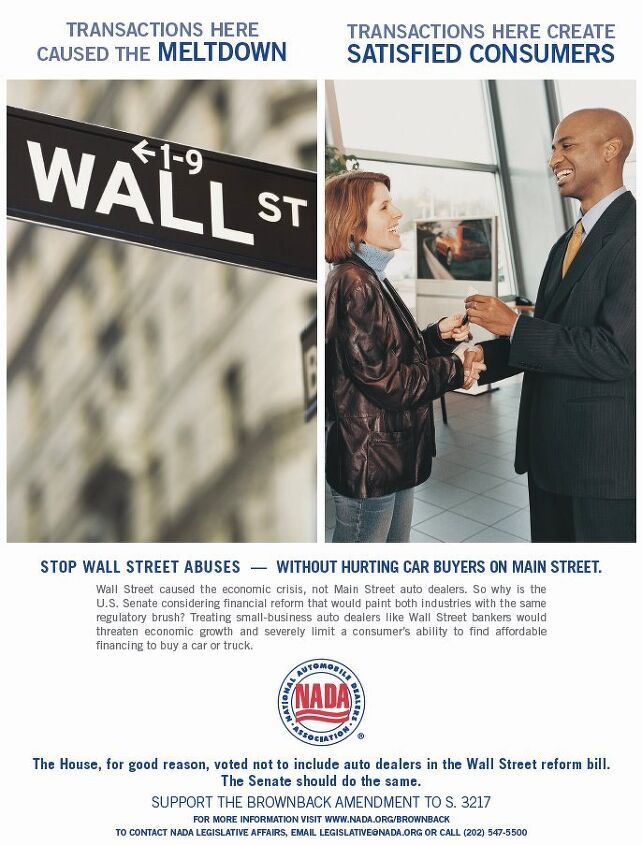

President Obama has weighed in on a crucial matter facing legislators attempting to overhaul America’s financial system: whether or not auto dealer finance should be subject to regulation by the new Consumer Protection Agency. Unsurprisingly, he has come down on the side of regulation, specifically echoing concerns voiced earlier by the Pentagon. The National Automobile Dealers Association has vowed to fight attempts to regulate dealer finance.

Statement by President Obama on Financial Reform

Claims by opponents of reform that this legislation unfairly targets auto dealers are simply mistaken. The fact is, auto dealer-lenders make nearly 80 percent of the automobile loans in our country, and these lenders should be subject to the same standards as any local or community bank that provides loans. Auto dealer-lenders offering transparent and fair financing products to their customers should welcome these reforms, which will make their competitors who don’t play by the rules compete on a level playing field.

We simply cannot let lobbyist-inspired loopholes and special carve-outs weaken real reform that will empower American families. I urge the Senate to continue to defeat the efforts of special interests to weaken protections for all American consumers.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Varezhka Maybe the volume was not big enough to really matter anyways, but losing a “passenger car” for a mostly “light truck” line-up should help Subaru with their CAFE numbers too.

- Varezhka For this category my car of choice would be the CX-50. But between the two cars listed I’d select the RAV4 over CR-V. I’ve always preferred NA over small turbos and for hybrids THS’ longer history shows in its refinement.

- AZFelix I would suggest a variation on the 'fcuk, marry, kill' game using 'track, buy, lease' with three similar automotive selections.

- Formula m For the gas versions I like the Honda CRV. Haven’t driven the hybrids yet.

- SCE to AUX All that lift makes for an easy rollover of your $70k truck.

Comments

Join the conversation

I'm kinda surprised that it took this long for this subject to come up here. We're regulated to the tooth already. Where are the AG's that should be prosecuting the scheisters that are taking advantage of our military personnel? Why can't I type a single word without the error message of "we don't know what we have here"? Why aren't the AG's enforcing the existing laws? The Brownback Amendment DOES NOT EXCLUDE BUY HERE PAY HERE lots. We are capped at 2% mark up of interest rates. When the manufacturers subsidize finance rates, we receive $100.00, depending on who the captive is. On the rare occasion that we do a sub-prime deal to someone who is unworthy of getting financing through banks and credit unions, the banks' charges to us, which we are forbidden to pass on to the consumers, is almost always four figures. That barely leaves us enough to pay the salesperson's flat $100 commission. Forget about covering their salary, healthcare, 401k match, and all the other over head that goes into a new car store. If you think that the paperwork process takes too long already, it's because the majority of us who are honest, law abiding dealers are following the law. Another layer of regulation will not speed things up any. A lot of dealers give back to their communities but I never hear any complaints about that. Here's what NADA has to say today, read carefully: Auto Dealers Take Issue with Misleading Statements from White House on Financial Reform WASHINGTON – NADA Chairman Ed Tonkin issued the following remarks yesterday in response to a statement from President Obama on financial reform: “Sadly, the White House is continuing to issue misleading statements in its efforts to get auto dealers wrongly included in Wall Street reform legislation. Much of what’s included in its latest statement is pure fiction. “For example: 1. It urges senators not to support the Brownback amendment because financial reform needs to include ‘auto-dealer lenders.’ But the Brownback amendment does not exempt auto-dealer lenders. Any dealer, bank, credit union or other finance company that actually underwrites and funds auto loans would be subject to the proposed consumer protection agency. And we’re absolutely fine with that. What we don’t support is including auto dealers who simply assist customers to find auto financing. These dealers are not banks. They are facilitators. And dealer-assisted financing is already heavily regulated – and should not be subject to double regulation. 2. The enormous set of consumer protection laws that currently governs dealers will be preserved under the Brownback amendment. Despite what the Administration suggests, unfair and deceptive practices are currently illegal and would remain so if the Brownback amendment is passed. Moreover, all of the laws that dealers are currently subject to (e.g., Equal Credit Opportunity Act, Truth In Lending Act, Federal Consumer Leasing Act, Fair Credit Reporting Act, Gramm Leach Bliley Act, Federal Trade Commission Act) would still exist and apply to dealers if the Brownback Amendment is approved.[1] “At the core of the Administration’s attack on dealer-assisted financing is the assertion that dealers routinely place consumers in ‘loans with higher interest rates than the borrower qualifies for.’ This statement is patently false. What’s worse, it manifests either an inability or a refusal on the part of the Administration to recognize how the market, which they claim needs more regulations, actually works. “Dealer-assisted financing – which is always optional – regularly affords consumers more favorable terms than those available through other sources. Yet, the Administration seeks to subject dealers to an agency which is being directed to create an uneven playing field by declaring off-limits for dealers practices that will be preserved for community banks, credit unions and other direct lenders. “For the President, in the statement attributed to him, to malign an entire industry made up of Main Street businesses run by dedicated men and women and their employees is shocking. We urge senators to resist this latest round of scare tactics and vote in favor of the Brownback amendment to preserve affordable auto finance options for consumers." [1] The Brownback Amendment specifically states that, “nothing in this section shall be construed to modify, limit, or supersede the rulemaking or enforcement authority over motor vehicle dealers that could be exercised by any Federal department or agency on the day before the date of enactment of this Act.” Source: NADAFrontPage.com

Oops, I almost forgot my political remarks: this pitting of military against car dealers is another example of the government's attempts of dividing us to conquer us. That said publicly, now I'm probably on some watch list...