Piston Slap: Playing Stratego at the Roundel

Andy writes:

Sajeev, I enjoy your posts on TTAC and I wanted to ask a quick lease negotiation question. Currently BMW has very good lease rates on their 5 series models. Is there a smart way to renegotiate the 10k mile/year limit? That just seems like a lot of money for 10k miles per year.

Sajeev answers:

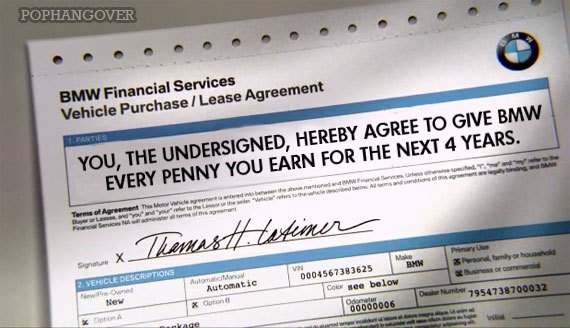

Unless you are a very profitable business, enjoy tax loopholes for gigantic SUVs and just gotta have a new ride every 2-3 years, leasing isn’t great for anyone. But conservative fiscal policy aside, I’ve yet to see a negotiable mileage rates in a lease. That’s not to say you shouldn’t ask, but the (corporate level) finance guys usually lock that in.

I’d attack from a different angle: complain about the mileage limit and insist on leasing for Invoice price minus ALL factory incentives, including the ones given to dealers in their holdback. Don’t worry about being a tightwad, dealerships make good money on leasing. Not to mention they probably won’t give you all of that holdback anyway, but you still gotta play hardball.

Not only do the words “invoice” and “holdback” get a salesperson to take notice, they’ll take action if lowering the car’s transaction price sells the lease. Because lowering that price is far, far easier to finagle on the dealership’s part.

Hopefully you can make the numbers work from a different angle.

(Send your queries to mehta@ttac.com)

More by Sajeev Mehta

Comments

Join the conversation

Yea you can always roll in your taxes on a lease. In states with a usage tax leasing makes a lot more sense than states with cap cost tax. usage tax allows you to pay taxes only on the value of the vehicle oyu are using up by the lease. Capitol Cost taxes are taxed on the entire cost of the vehicle. Cap Cost taxes can add a lot to the monthly payment on an expensive vehicle. You can easily add $200/month to a 36 month lease on a 100k car at 7.25%. Cut that figure in half wiht a usage tax.

Aside from business application leases, especially those where the vehicle is going to be rightfully claimed as a 100% dedicated to business vehicle, I've yet to see a single instance where leasing is a more prudent financial decision than purchasing the exact same vehicle. As mentioned by so many earlier, the spread between the savings on a purchase versus a lease becomes even greater with the passage of time. Assuming a relatively normal 12,000 to 15,000 miles per year, depreciation on a car that was purchased new really slows down dramatically in about year 4, and grinds to a crawl in about year 7. In 'The Millionaire Next Door,' the two financial planners who authored the book speak about how most wealthy individuals buy modestly priced cars and drive them for 10 years or more. Interestingly enough, many of the cars the wealthy drive are domestic makes, and the Ford F-150 is among the most common vehicle they drive.

With leasing it depends. There is an old expression - never acquire a depreciating asset. Cars are the worst. If you buy, you lost so much the first few years. It makes sense only if you want that car for sure, for 8-10 years. Lifestyles change, etc. Could make you regret a particular car. Selling a used car is a hassle. You meet interesting people with ads and usually get the shaft at a dealer. Plus, what you think your car is worth is rarely what the market will bear (what someone will pay for it). For me, I have an old Volvo and just leased a Mustang GT for 250/mo, zero down. The Volvo will last another 10 years, if not, I will pick up another used Volvo since I know that car so well (it has been reliable). I would not lease anything that required a down payment, which is their depreciation. And leasing could be a good way to own a car you think you like but are not sure it is reliable. If it is, you can buy it out afterwards having known the car its whole life. There is something in that security. How many Toyota owners are regretting trading their old cars right now? Some are no doubt. Leasing luxury cars can be a way to avoid the massive depreciation hit of ownership. Who wants a 10 year old BMW? Look at Carmax to get an idea of what used cars are selling for (of course they paid less to their owners). It's scary. Better to have a beater and new car every 2-3 years.