Incentives, Fleets Fattened February Sales

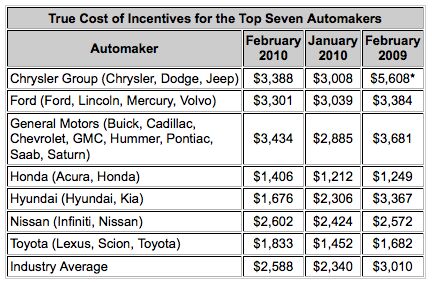

Chrysler once again topped Edmunds’ True Cost Of Incentive index last month, despite failing to significantly improve its sales over February 2009’s miserable showing. The only upside is that Chrysler basically held even with reduced incentives, as the entire industry is spending about 14 percent less on incentives than it did a year ago. Another interesting point of analysis from Edmunds:

Comparing all brands, in February smart spent the least, $341 followed by Scion at $426 per vehicle sold. At the other end of the spectrum, Lincoln spent the most, $5,568, followed by HUMMER at $5,195 per vehicle sold. Relative to their vehicle prices, Saturn and HUMMER spent the most, 14.9 percent and 13.6 percent of sticker price, respectively; while Porsche spent 1.4 and smart spent 2.3 percent.

But Toyota and GM will help carry those numbers up next month, with huge incentive spends planned. Meanwhile, after many automakers found religion about retail sales last year, fleet sales are back in a big way. And they’re no longer seen as something to be ashamed of.

Automotive News [sub] reports that only 35,832 of Chrysler’s 84,449 sales last month were to retail customers, with the remaining 58 percent going to fleets. Despite the fact that this combined with Chrysler’s chart-topping incentives doesn’t exactly speak to the company’s viability, Chrysler spokesfolks were unapologetic, saying:

Fleet sales were very strong this month, and our company sales reflect that. We still expect our total fleet sales for the year to be around 25 percent. It’s a good viable business for us. It shows that large companies have faith in our company to order. We make money on fleet sales

And none of the automakers are being snobbish about fleet sales. Ford’s fleet sales rose 74 percent compared to last February, and GM’s fleet sales rose 114 percent, making up nearly a third of all GM sales according to Automotive News [sub]. GM’s leasing (another former sin) also rose last month, to make up ten percent of all deliveries.

This time last year, fleet sales, incentives and leasing were considered part of the huge collection of problems that brough American automakers to their knees. Now that they’ve received their bailouts, the old habits are coming right back. And there are always excuses: sure they make some profit and yes, they will always be part of the business. But with incentives going up and Toyota looking vulnerable, a discount war is looming on the horizon. If Detroit once again gets caught up in a negative spiral of volume-pushing through incentives, fleets and leasing, any chance of a sustainable turnaround could be hamstrung. Those who fail to learn the lessons of the last several years have no business being in business.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy TG grows skeptical about his government protecting him from bad decisions.

- Calrson Fan Jeff - Agree with what you said. I think currently an EV pick-up could work in a commercial/fleet application. As someone on this site stated, w/current tech. battery vehicles just do not scale well. EBFlex - No one wanted to hate the Cyber Truck more than me but I can't ignore all the new technology and innovative thinking that went into it. There is a lot I like about it. GM, Ford & Ram should incorporate some it's design cues into their ICE trucks.

- Michael S6 Very confusing if the move is permanent or temporary.

- Jrhurren Worked in Detroit 18 years, live 20 minutes away. Ren Cen is a gem, but a very terrible design inside. I’m surprised GM stuck it out as long as they did there.

- Carson D I thought that this was going to be a comparison of BFGoodrich's different truck tires.

Comments

Join the conversation

"Chrysler once again topped Edmunds’ True Cost Of Incentive index last month" - but only by $87 more than Ford, the current dandy of TTAC, at least until Toyota fixes it's (perception) problem of UA. Another interesting thing; going from the bottom of the chart to the top, comparing this Feb. with a year ago we see: Toyota increased its incentives Nissan increased its incentives Hyundai decreased its incentives Honda increased its incentives GM decreased its incentives Ford decreased its incentives Chrysler decreased its incentives - significantly. Finally, if Chrysler sales in Feb to fleets were 58%, but the company says they expect fleet sales for the year to be about 25%, does that mean this is simply the peak fleet sales month? Like Christmas for fleet sales? It makes sense because Feb is slow selling time for retail (better chance of good fleet deals) and rental companies would want to stock up for the summer travel season. I don't know. I'm just trying to make some sense of this. Anyone here work in the industy in sales & marketing or in the rental or fleet business that could shed some light on this?

I know I recently got a mail from a toyota dealership of 0% for 5 years on 8 different models....I think that might have been March 1. I can't wait to see the numbers once march is over.