Sears Signs Up Former GM & Chrysler Dealers: Are Chinese/Indian Cars Next?

GM and Chrysler were already culling dealers before their bankruptcies, which hastened the process. Many of those dealerships were profitable businesses, often family owned, whether or not they were ultimately an asset to the parent automakers. Dealers have established regional brand equity, being major advertisers in their markets. The dealers losing their franchises have explored what few options they have. There are lobbying efforts at the state and national levels to protect the affected dealers with some kind of legislation. Some have signed up with Hyundai & Kia, as the low priced Korean automakers thrive in the recession. Others, recognizing that new car sales are often a wash, and that repair service and used car sales are profit centers, have stayed in business as used car dealerships or automotive service centers.

Now Sears Roebuck & Co. has offered some of those culled dealers another lifeline. Banking on the reputation of its DieHard battery brand as well as being one of the country’s leader tire retailers, Sears is launching the Independent Sears Auto Center franchise program, starting with a former Chrysler dealer in New Jersey, the Coleman Auto Group. Participating stores will offer Sears’ full automotive product line of batteries, tire, accesories as well as repair services and replacement parts.

On paper this appears to be a win-win. Sears is a well established player in the replacement battery and tire market. Every Sears store has a large automotive department that sells those tires and batteries as well as a fairly extensive selection of car and truck accessories. The brand’s association with cars and car repair in consumers’ minds is solid – even if we’ve never bought a DieHard, we’ve all shopped at Sears at one time or another and have passed through their automotive department. The automotive franchising program is in line with Sears’ other efforts to expand their brand like the standalone Sears hardware stores and putting Craftsman products in Kmart stores. This will help sell more DieHards.

For the dealers, who have retail showrooms, parts departments, and extensively and expensively equipped service departments, becoming a Sears franchise allows them to try and recover that investments. For dealers who maintain their used-car sales department, the Sears brand will help restore some brand name cachet that they lost with their GM or Chrysler franchise. Put another way, it reduces the stigma attached to used-car dealers.

Bill Jackson, Senior Vice President of Sears Holdings Corp. and President of Sears

Authorized Independent Auto Centers, LLC. said “For customers, Sears Auto Centers will be more convenient than ever, with more locations providing our full product and service offerings. This is also a great opportunity for dealers who are currently selling used cars to gain a brand that’s nationally recognized for quality and dependability, a resource for buying high-quality auto parts and supplies, and access to a proven business model that has been tailored to their needs.”

It’s intriguing that Sears specifically mentioned dealers who continue to sell cars. Sears in addition to being a general retailer has some valuable brand names like Kenmore and Craftsman but the company has rarely, if ever, manufactured its own products. Kenmore washing machines are made by Whirlpool in Benton Harbor, Michigan and now that a lot of manufacturing has moved to China, Sears has plenty of experience working with Chinese vendors. Downstream I can see a network of Sears automotive centers being an attractive sales venue for emerging foreign automakers.

Already there’s been speculation that Chinese or Indian automakers will entirely bypass the traditional dealer model and sell their cars in big box stores like Wallmart or Costco. That speculation was started by BYD’s claim at the recent NAIAS that they would be selling cars in the US by the end of this year, though they have no distribution or dealer channel in place. Honda VP John Mendel, who said that selling cars in “warehouse stores or electronic stores” could destroy the current auto dealer business model, gave that speculation some credence.

The major obstacle to abandoning the traditional car dealer model has been after sales service. As Ed Niedermeyer pointed out, a US spec Tata Nano might be cheap but a $5,000 car is not as disposable as a $300 tv set.

A network of name branded automotive service centers, already experienced with retail car sales would be a natural fit for a Chinese or Indian automaker trying to break into the US market.

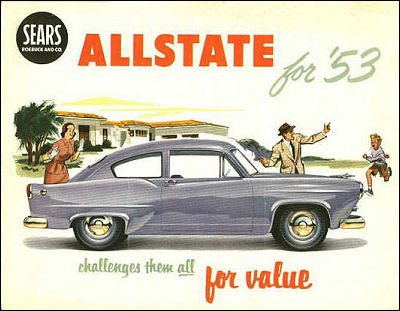

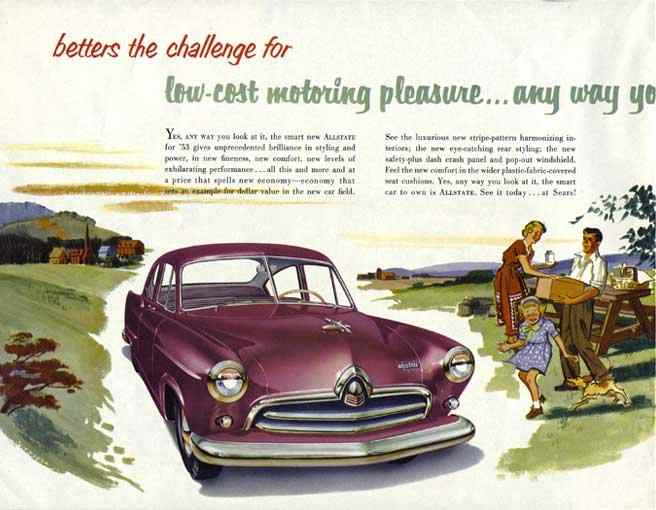

Ironically, this would not be the first time Sears has tried to bypass the traditional auto dealer business model. In 1952, Sears Roebuck introduced the Sears Allstate, sold through their Allstate auto accessory stores and advertised in their catalog. Manufactured by Kaiser-Frazer, the Allstate was a badge engineered Henry J. After-sales service was supposed to be provided by K-F dealers. It came in two models, Standard for $1,395 and Deluxe for $1,796. One of a number of economy priced models introduced by small automakers in the early 1950s to less than enthusiastic consumer response, only 1,600 (one source says 2,300) Sears Allstates were sold and Sears left the new car business in 1953 after only two years. In the case of the Allstate, it was hamstrung by internal politics at Kaiser-Frazer. The company liked the idea of another retail channel, but its dealers didn’t want the competition, service revenue notwithstanding. Sales were also hampered by the fact that the car was too expensive a product to keep in inventory – customers had to order and wait. Also, the lack of dealers meant no trade-in opportunities.

Actually, the Allstate was not Sears’ first attempt to retail cars under its own brand without using the traditional dealer network, though back in 1908 car dealers were not old enough to be traditional. Nor were they in every town and hamlet. Much of America was still rural and people ordered just about everything in their house from the Sears Roebuck & Company catalog, including, sometimes, the house itself. Sears was a reputable business and every town had a railroad depot.

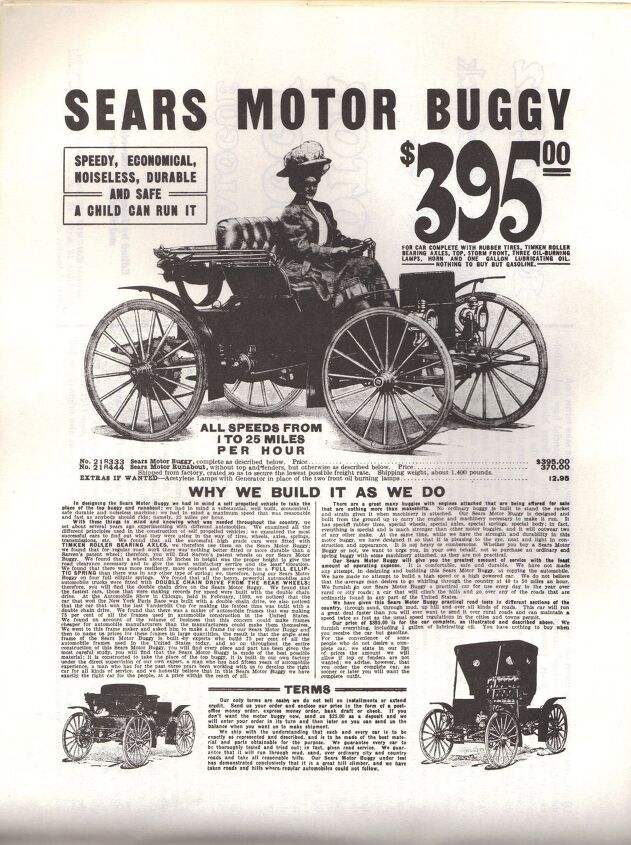

The 1909 Sears, Roebuck & Co. catalog advertised the Sears Motor Buggy for $395 plus shipping to the nearest train station, $370 without fenders and top. The car could also be delivered at the Chicago factory ready to drive.

Acetylene headlamps were an option ($2.95) as were speedometers, though with 10 HP (later models had 14 HP) and a 25 mph top speed, they were hardly necessary. Sears advertised the Motor Buggy as “so safe that a child could run it.” To save on shipping costs some assembly was required to drive the car home, but it did come with an instruction manual and a gallon of lubricating oil.

Alvaro S. Krotz, electric vehicle pioneer and the inventor of treaded tires, designed the Motor Buggy. He supervised assembly, using components made by suppliers to the then young automobile industry. Sears advertised that the Motor Buggy used an “angle steel frame built by experts that build 75 percent of the automobile frames used in the United States today”. Reeves supplied the 2 cylinder air cooled gasoline engine.

The Sears Motor Buggy’s slogan was ‘Lowest in Original Cost – Lowest in Upkeep Cost’ and considering that it was half the price of the then recently introduced Ford Model T and the Sears catalog’s ubiquity, it should have been a success.

Indeed, the Motor Buggy was more successful than the Allstate, at least in terms of sales, but both are pretty much trivial anecdotes of automotive history (though a useful angle for a story about Sears, culled dealers and Chinese and Indian car imports). Approximately 3,000 Motor Buggies were sold until Sears, which lost money on each, stopped selling them in 1912 and sold the tooling to the Lincoln Motor Car Works (unrelated to Ford’s Lincoln brand) one of their suppliers.

So while Sears has some experience selling cars outside the normal dealer networks, that experience has not been profitable or long lived. Even today among the biggest obstacles to establishing a car brand in the US are distribution and retail sales. After sales service (including warranty work) is just as important in 2010 as it was in 1952 and 1908. The Sears Motor Buggy had a huge price advantage over its competitors but no dealers to service the car. Even worse, most buyers had to finish assembly themselves, the world’s first kit car. Kaiser-Frazer dealers were reluctant to service Sears Allstates and you couldn’t go back to Sears and trade in your Allstate on a new model.

It’s not too hard to load cars onto a ship. Convincing entrepreneurs to plunk down hard cash for a franchise with an unproven brand is considerably more difficult. Analysts say that 150-200 is the minimum dealer count to introduce a new brand. By comparison, Subaru and Hyundai, two brands that are adding dealers, not culling them, each have 600-700 dealers, both after decades in North America. Should Sears franchise a few hundred Independent Sears Auto Centers that could be an enticing distribution channel for an automaker trying to enter the US market.

Ronnie Schreiber edits Cars In Depth, the original 3D car site.

More by Ronnie Schreiber

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- IBx1 Everyone in the working class (if you’re not in the obscenely wealthy capital class and you perform work for money you’re working class) should unionize.

- Jrhurren Legend

- Ltcmgm78 Imagine the feeling of fulfillment he must have when he looks upon all the improvements to the Corvette over time!

- ToolGuy "The car is the eye in my head and I have never spared money on it, no less, it is not new and is over 30 years old."• Translation please?(Theories: written by AI; written by an engineer lol)

- Ltcmgm78 It depends on whether or not the union is a help or a hindrance to the manufacturer and workers. A union isn't needed if the manufacturer takes care of its workers.

Comments

Join the conversation

Wow, I like the idea of Craftsman trucks. A lot. Perhaps once Chry-slur-FIAT implodes, Sears could pick up the Hemi engine plant and truck plant in old Mexico and turn out Craftsman trucks, as well as maybe just maybe using the plant to also assemble CKD kits from some Indian or Taiwanese auto supplier. Sears Craftsman cars AND trucks. Ditto on the need for one heck of a guarantee. In fact, to stand out from the competition, I'd not only give the vehicles a 100,000 mile warrantee, but would include all the servicing for the first year/15,000 miles as part of the purchase, too. (This gets the buyers "used to" coming back to Sears for services - hopefully making this a regular habit when they have to pay). And use Saturn style no quibble (but fair) pricing. Sears isn't a damn middle-eastern bazaar; set the price fairly and leave it (except for the occasional sale price, which couldn't be as steep as it is on other items given the thinner profit margin). I can see everyone's point about trade-ins and used cars. But only sell the BETTER cars and include a warrantee as well as a Carfax on all cars - if they don't meet standards, broom them at auction. Sears tried to tie up with Kaiser way back before they started buying Henry J's - there were mock-ups of full sized Kaiser/Frazer cars drawn up by Kaiser stylists in the late 1940's. Some of the board members on Sears's board were on Kaiser-Frazer's, too. (You know, "the old boy network").

A Kenmore Camaro! And, my new refrigerator has Continental suicide doors. Truly impressive cross-fertilization.