Now Playing At TTAC: New Car Sales Since 1993

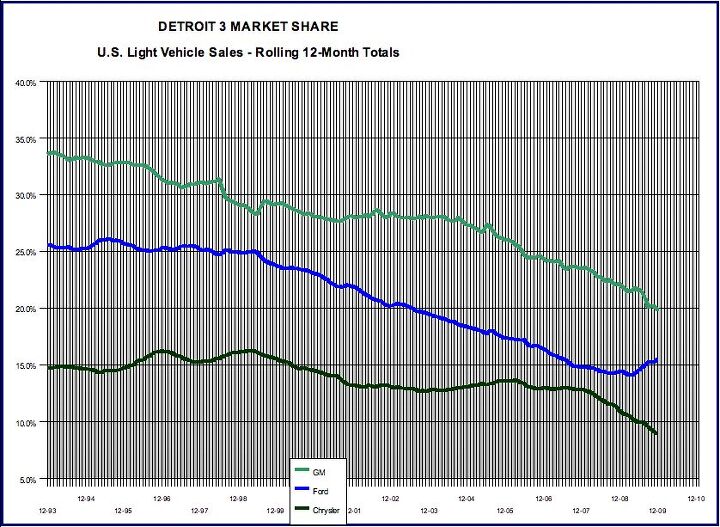

What’s wrong with this picture? TTAC loves sales data, but lately we’ve become a little jaded with our own efforts to provide a thorough look under the hood of the industry. And as everyone in the auto business knows, when the going gets tough, the tough get outsourcing. TTAC is proud to announce that we’ve concluded a deal with the fine data crunchers at Morgan & Company, giving us (and you!) access to their magical spreadsheet kingdom. Needless to say, we’ll be spending much of 2010 wallowing in the beautiful data in hopes of providing a better picture of the industry’s nuts and bolts. For now, check out this chart of Detroit’s market share swan dive since the early 90s. One of these things is not like the other…

More by Edward Niedermeyer

Comments

Join the conversation

Absolutely correct. All through the 90s until early 2008, Chrysler hung pretty steady, with share ranging from around 13 to 17 percent (which, incidentally, has been their share pretty much since the 50s). Much of this was during the time in which they were (ahem) the most profitable car company in the US. Much of it during the time that Daimler was sucking it dry, using the cash that Chrysler was spinning off to offset the red ink of the Mercedes unit during Jurgen Schremp's years. Ford, too, stayed pretty steady after coming out of its tough period in the early 80s, until the Nasser years. The problem with this chart is that it does not start early enough. It needs to go back another ten years, so that it would show Ford and Chrysler in the same range that they were in during the 90s, but showing GM falling from a share in the mid 40s with no letup.

There's a double-whammy here: declining shares in a significantly shrunken market. For Chrysler, this is the end, my friend... the end. Their downtrend will steepen, because they're reaching the point at which prospective customers will no longer believe the company can remain in business. The worse this gets, the faster it will get worse. My political instinct is that the end will come sooner rather than later. The Democrats currently have a big problem brewing regarding the November elections, and I expect they will want to neutralize the Chrysler boondoggle as an issue before then. That means "selling" the pieces to whoever will take them, and closing the doors. Then they will declare that the free marketplace has spoken.

Ford gained share last year against GM and Chrysler for two main reasons:

1) A much better rounded product portfolio. GM has a few hits and a bunch of also rans. Chrysler has mostly also rans. Ford, on the other hand, has very few stinkers. Even its oldest products (Panther & Ranger) still are strong in their niches.

2) Ford kept its dealer base and brand base largely intact.

I fully expect to see the GM and Ford market share lines cross sometime in the next few years.

I'm curious as to whether improved quality and reliability over time has impacted sales. For example, if a company were to make great cars that last 20 years and over a 10 year span everyone noticed this and bought one...isn't that second decade going to be a real kick in the shorts?