Inside GM's December Sales

Speaking to Bloomberg yesterday, GM Sales Boss Susan Docherty called December’s sales results “very encouraging.” Her argument: heavy fleet sales in December 2008 explain why December 09 results look worse by comparison. But spinning sales results as the product of conscious fleet percentage reductions is just one longstanding GM tradition that Docherty indulged in: talking points touting falling incentives and improved inventory weren’t far behind. None of which is necessarily indicative of a satisfactory performance. In fact, if you dissect the spin, it’s clear that what lies beneath is not nearly as attractive as the PR would have you believe.

Automotive News [sub] buys the fleet sales line hook, line and sinker, running the headline “GM’s December wasn’t as bad as it looked.” Sure, 22 percent fleet is a pretty balanced number, and there’s no doubt that it’s an improvement on the 33 percent of a year ago. But even according to GM’s own numbers, that merely puts the General mid-pack in terms of fleet percentages. According to Docherty’s estimates, Ford sold 35 percent of its vehicles to fleets, Chrysler Group’s fleet percentage was “about half,” Toyota Motor Sales had 10 percent and Hyundai-Kia 22 percent. Those numbers indicate previously unforeseen trouble at Ford and totally predictable trouble at Chrysler, although GM surely wouldn’t want to even compare itself to the disaster going down in Auburn Hills. On the fleet front, GM’s performance can best be described as “adequate.” But reducing fleet deliveries doesn’t necessarily mean an improvement in profits.

The big news going largely unnoticed, is that despite Docherty’s insistence that incentives are down 25 percent, Edmunds.com still estimates GM to have the highest “true cost” of incentives in the business. Still. Sure, GM’s incentives are down by about $340 since November, but at $4,077 per vehicle, GM still outspends the next-biggest incentive addict, Ford, by over $1,000 per vehicle. Even Chrysler is down to about $2,500 per vehicle. December incentive data from Automotive News [sub]’s data center shows incentive offers throughout December on even the new launch products and “core brands” Docherty credits her optimism to. From the Cadillac SRX (up to $2k and 1.9%) to the GMC Terrain and Chevy Equinox (up to $1k and 2.9%), almost every 2010 model has something on the hood that might entice buyers but will definitely cost GM at the bottom line. The exceptions to this are the Buick LaCrosse and Chevy Camaro, which had no cash on the hood in December (although 3.9 percent is available on LaCrosse).

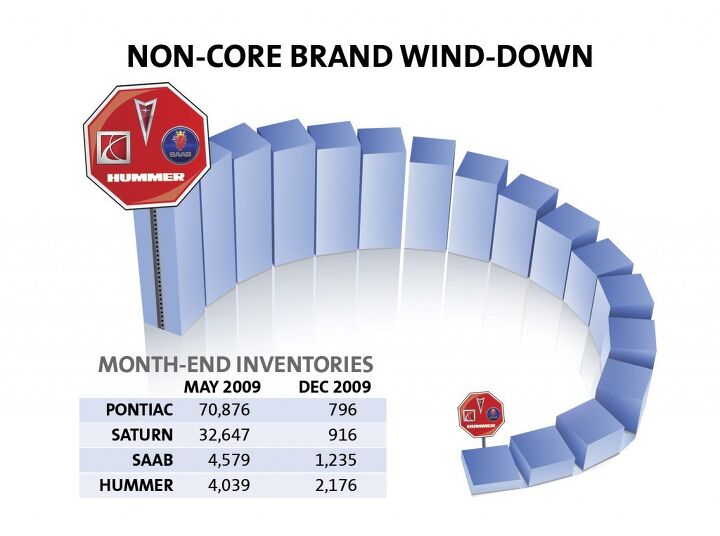

The comparison of incentives on core versus non-core brands is the final piece of the puzzle. Though rumors of $7k dealer incentives on Pontiacs and Saturns sent their search numbers way up, the only official offers were $4k and 0% interest on Saturns, and $2,500-$2,500 incentives on Pontiacs with financing as low as 0 percent. Hummer is helping bump averages up, by offering up to $6k off of H3s, with $5k dealer cash on H2s. There are no consumer incentives on Saabs, but dealers are being offered $7k for each 9-3 and 9-5 sold, or $8k for each 9-7X. Though 2010 models in the core brands typically have consumer cash incentives limited to about $2k per vehicle, 2009 models are stacked deep.

Any 2009-model Cadillac, for example, has a minimum of $3k on the hood (CTS, SRX), and as much as $10k in consumer cash for XLR. The five percent upswing in DTS sales, for example, could be attributed to $2k incentives for a 2010 or $5k incentives for a 2009 model. On the other end of the spectrum, a nearly 50 percent drop in Lucerne sales shows how moribund that vehicle is, considering that incentives for 2009 models reach $4,500. A 2010-model Malibu (sales up 11 percent in December) received $1,500 ($2k for a 2009) compared to a maximum of $750 for a Camry and no incentives for comparable Honda, Hyundai, or Mazda models. Enclave sales climbed over the 5k mark, thanks to as much as $2k off of 2010 models and $2,500 off 09s.

But if there’s a “core brand” that is seriously addicted to incentives, it’s GMC. The alleged profit center brand offered $2k off of every 2010 Yukon and Sierra (up to $4k on 2009s), and rode $1,500 off 2010 Acadias ($2,500 off 2009 Acadias) to a 61.3 percent sales increase. GMC won’t deliver much actual profit if this keeps up, nor will it sustain its higher prices if everything has cash on the hood.

And that, in a nutshell, is why GM is in such trouble sales-wise. The deepest discounts in the industry are, once again, failing to move the needle sales-wise. GM can slice and dice the statistics any way they want, but the reality is that sales are stagnant. Without incentives, who knows what would happen. New products are launching with cash on the hood, old models aren’t moving even with the incentives piled high. Something has got to give.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Fahrvergnugen cannot remember the last time i cared about a new bmw.

- Analoggrotto More useless articles.

- Spamvw Did clears to my '02 Jetta front markers in '02. Had to change the lamps to Amber. Looked a lot better on the grey wagon.I'm guessing smoked is illegal as it won't reflect anymore. But don't say anything about my E-codes, and I won't say anything about your smoked markers.

- Theflyersfan OK, I'm going to stretch the words "positive change" to the breaking point here, but there might be some positive change going on with the beaver grille here. This picture was at Car and Driver. You'll notice that the grille now dives into a larger lower air intake instead of really standing out in a sea of plastic. In darker colors like this blue, it somewhat conceals the absolute obscene amount of real estate this unneeded monstrosity of a failed styling attempt takes up. The Euro front plate might be hiding some sins as well. You be the judge.

- Theflyersfan I know given the body style they'll sell dozens, but for those of us who grew up wanting a nice Prelude Si with 4WS but our student budgets said no way, it'd be interesting to see if Honda can persuade GenX-ers to open their wallets for one. Civic Type-R powertrain in a coupe body style? Mild hybrid if they have to? The holy grail will still be if Honda gives the ultimate middle finger towards all things EV and hybrid, hides a few engineers in the basement away from spy cameras and leaks, comes up with a limited run of 9,000 rpm engines and gives us the last gasp of the S2000 once again. A send off to remind us of when once they screamed before everything sounds like a whirring appliance.

Comments

Join the conversation

So AFIAK no new Pontiac/Saturn/Saab's are being built - so they will eventually disappear from the sales results. Are Hummer's still being built?

For GM's core brands, sales were up 2.2% in December. Buick was up 37.4% Caddy up 11.4% Chevy down 1.5% GMC up 4.8% For the record, none core brands were down 55% which is why you see down 6% overall. I don't think this is bad news for GM at all. My guess is most of the fleet reduction was at Chevy. Probably some at Buick as well since the old LaCrosse is gone. Overall, I don't think this is a bad month when you consider what brands are selling the cars and GM still being gov't owned as a negative to the consumer.