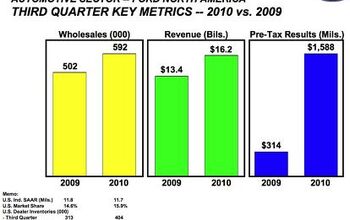

Ford Posts $997 Million 3Q Profit

Ford turned a profit in the second quarter of this year, thanks to a share offering and other debt-reduction actions which covered a $424M pre-tax operating loss. In the third quarter, however, Ford’s profit needs no such qualification. Pre-tax operating profits were $1.1B, including a $357M from North American operations. For the record, this marks the first Ford North America profit since Q1 2005. Perhaps more importantly, for an automaker that’s mortgaged up to (and including) its logo, Ford’s cash pile grew by $2.8B (on $1.3B positive cashflow), to $23.8B. On the strength of these surprisingly strong results, Ford has revised its 2010 guidance from being “break even or better” to “solidly profitable.” The future is looking far brighter for Ford than any of its cross-town rivals, but there are a few more considerations to keep in mind before we can pronounce Ford officially out of the woods. Even the Blue Oval is warning that its 2010 guidance will be revisited after full-year results are in.

Perhaps most importantly, 3Q profit from North American operations have to be seen in the context of Cash for Clunkers stimulus. Not only did volumes increase due to the $3B federal stimulus, but transaction prices were high as well. With the government offering up to $4,500 off of qualifying models, dealers were charging full price for much of the third quarter. Ford acknowledges [via the WSJ] that “lower material costs, job cuts and consumers buying more high-end models equipped with technology features,” contributed to its domestic profits. Whether Ford’s North American operations can turn a healthy profit without government stimulus remains to be seen.

In Europe, Ford’s sales have also been kept afloat on a wave of stimulus. Citing the end of clunker-stimulus in Germany, a slowdown in the UK and a savage downturn in the Russian market, Ford’s CFO notes:

Looking at 2010 there is a high likelihood of a substantial decrease in European industry volumes. This decrease could more than offset U.S. sales volumes which may improve somewhat from this past quarter’s results.

Though European pre-tax profits grew to $193M, revenue actually fell 21 percent to $7.6 billion. The falling revenue-increasing profit model was replicated in the Asia/Pacific region which posted $27M profits, despite revenue falling 11 percent to $1.5 billion. South American operations saw revenue fall 22 percent to $2.1 billion, although profits of $247M were down compared to last year on currency losses.

Ford’s overall revenue fell in the third quarter even when compared to 3Q 2008’s miserable performance. The major lesson from these third quarter results is that Ford is cutting its costs admirably to cope with reduced demand. The second major lesson: Ford needs to show it can keep revenue from falling further when post-clunker stimulus results come in in December. Meanwhile, a deeper downturn in European markets could spell real trouble in the short term, while modest gains in Asian growth markets point to longer-term challenges. By Detroit standards, however, these results are about as close to peachy as they’ve been in a long while. Just don’t tell the UAW . . . .

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Theflyersfan I wonder how many people recalled these after watching EuroCrash. There's someone one street over that has a similar yellow one of these, and you can tell he loves that car. It was just a tough sell - too expensive, way too heavy, zero passenger space, limited cargo bed, but for a chunk of the population, looked awesome. This was always meant to be a one and done car. Hopefully some are still running 20 years from now so we have a "remember when?" moment with them.

- Lorenzo A friend bought one of these new. Six months later he traded it in for a Chrysler PT Cruiser. He already had a 1998 Corvette, so I thought he just wanted more passenger space. It turned out someone broke into the SSR and stole $1500 of tools, without even breaking the lock. He figured nobody breaks into a PT Cruiser, but he had a custom trunk lock installed.

- Jeff Not bad just oil changes and tire rotations. Most of the recalls on my Maverick have been fixed with programming. Did have to buy 1 new tire for my Maverick got a nail in the sidewall.

- Carson D Some of my friends used to drive Tacomas. They bought them new about fifteen years ago, and they kept them for at least a decade. While it is true that they replaced their Tacomas with full-sized pickups that cost a fair amount of money, I don't think they'd have been Tacoma buyers in 2008 if a well-equipped 4x4 Tacoma cost the equivalent of $65K today. Call it a theory.

- Eliyahu A fine sedan made even nicer with the turbo. Honda could take a lesson in seat comfort.

Comments

Join the conversation

It is going to be extremely interesting to see how Ford did during the non-CFC stimulative months, versus the CFC-laced ones. We'll know later today.

It's nice to see they are reporting a profit, but they aren't out of the woods yet - lets take a wait and see attitude towards this IMHO. I see a lot of improvement in their line up, but they still have the UAW parasite attempting to bleed them dry. Not to mention C4C - we'll know better by the end of the year...lets see how Q4 plays out for them.