European Car Sales Accelerate Growth in September. Danger Ahead

European new car sales continue on their path of recovery. However, as the Abwrackprämien-fuel tank ran dry in Europe’s growth engine Germany, the party may come to a halt in October.

In September, European passenger car registrations increased by 6.3 percent, compared to September 2008. A total of 1,388,136 new cars were registered in all of Europe last month, the European Automobile Manufacturers Association (ACEA) reports today. Nine months into the year, registrations of new cars in all of Europe are still 6.6 percent lower than during the same period of 2008.

European new car registrations had reached their lowest point in January 2009, when new car sales were 27 percent below the same month in the prior year. Many European states enacted cash-for-clunker schemes, which helped turning the tide. New car sales grew steadily after January, and reached positive territory in June.

Growth has slowly but steadily accelerated in Europe ever since. September’s 6.3 percent amount to the highest growth number this year.

The West European market increased by 9.6 percent, the largest jump since 1999. Germany remained the best performer with +21 percent in September, less than the 28.4 percent growth recorded in August. For the first nine months of 2009, only three countries – Germany (+26.1%), Austria (+6.7%) and France (+2.4%) – saw their markets expand. Elsewhere in Western Europe, the meltdown ranged from minus 5.9 percent in Italy to a disastrous loss of 79.5 percent in Iceland. In the first nine months, 10.3 million new cars were registered in Western Europe, down 4.8 percent from the same period a year ago.

The new EU member states are still a basket case. Poland (+7.9 percent) and the Czech Republic (+0.5%) were the only ones posting growth in September. From January to September, new car registrations in Eastern Europe are down by 28.7 percent. The vast majority of markets declined sharply, ranging from -22.3 percent in Slovenia to -80.2 percent in Latvia. Nine months into the year, Slovakia (+19.7 percent), the Czech Republic (+8.0 percent) and Poland (+1.7 percent) were the only expanding markets in Europe’s East.

On the market share front, Volkswagen Group is the unassailable leader in Europe with 21.3 percent market share for the first nine months of 2009. PSA Group follows with 12.7 percent. Despite its Opel problems, GM Group is holding its own with 9.1 percent market share. Fiat Group and Renault Groups are nipping at GM’s heels with a share of 8.8 percent each. Makers in the luxury segments see their European market share erode: For the first nine months, BMW holds only 4.7 percent of the European market, down from 5.5 percent the year before. Daimler went down from 5.3 percent in the prior year to 4.7 percent this year. In September, Daimler lost a full percent of market share compared to September 2008.

As the cash-for-clunkers scheme came to an end in Europe’s largest market, Germany, industry sources predict that Europe’s recovery will stall in October. German car dealers report 50 percent less traffic than in August.

For you number crunchers, September data are available in their Excel glory here. Due to unannounced reasons, Ford’s market share numbers are AWOL. ACEA promised to deliver them when available.

European car sales accelerate growth in September. Danger ahead

European new car sales continue on their path of recovery. However, as the Abwrackprämien-fuel tank ran dry in Europe’s growth engine Germany, the party my come to a halt in October.

In September, European passenger car registrations increased by 6.3 percent, compared to September 2008. A total of 1,388,136 new cars were registered in all of Europe last month, the European Automobile Manufacturers Association (ACEA) reports today. Nine months into the year, registrations of new cars are still 6.6 percent lower than during the same period of 2008.

European new car registrations had reached their lowest point in January 2009, when new car sales were 27 percent below the same month in the prior year. Many European states enacted cash-for-clunker schemes, which helped turning the tide. New car sales grew steadily after January, and reached positive territory in June. Growth has slowly but steadily accelerated in Europe ever since. September’s 6.3 percent amount to the highest growth number this year.

The West European market increased by 9.6 percent, the largest jump since 1999. Germany remained the best performer with +21 percent in September, less than the 28.4 percent growth recorded in August. For the first nine months of 2009, only three countries – Germany (+26.1%), Austria (+6.7%) and France (+2.4%) – saw their markets expand. Elsewhere in Western Europe, the meltdown ranged from minus 5.9 percent in Italy to a disastrous loss of 79.5 percent in Iceland. In the first nine months, 10.3 million new cars were registered in Western Europe, down 4.8 percent from the same period a year ago.

The new EU member states are still a basket case. Poland (+7.9 percent) and the Czech Republic (+0.5%) were the only ones posting growth in September. From January to September, new car registrations in Eastern Europe are down by 28.7 percent. The vast majority of markets declined sharply, ranging from -22.3 percent in Slovenia to -80.2 percent in Latvia. Nine months into the year, Slovakia (+19.7 percent), the Czech Republic (+8.0 percent) and Poland (+1.7 percent) were the only expanding markets in Europe’s East.

On the market share front, Volkswagen Group is the unassailable leader in Europe with 21.3 percent market share for the first nine months of 2009. PSA Group follows with 12.7 percent. Despite its Opel problems, GM Group is holding its own with 9.1 percent market share. Fiat Group and Renault Groups are nipping at GM’s heels with a share of 8.8 percent each. Makers in the luxury segments see their European market share erode: For the first nine months, BMW holds only 4.7 percent of the European market, down from 45.5 percent the year before. Daimler went down from 5.3 percent in the prior year to 4.7 percent this year. In September, Daimler lost a full percent of market share compared to September 2008.

As the cash-for-clunkers scheme came to an end in Europe’s largest market, Germany, industry sources predict that Europe’s recovery will stall in October. German car dealers report 50 percent less traffic than in August.

For you number crunchers, September data are available in their Excel glory here. Due to unannounced reasons, Ford’s market share numbers are AWOL. ACEA promised to deliver them when available.

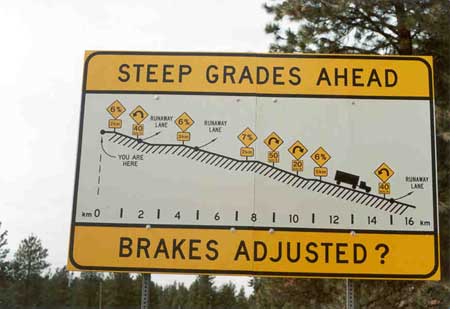

This way or that way? Picture courtesy themotorreport.com.au

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo Yes, they can recover from the Ghosn-led corporate types who cheapened vehicles in the worst ways, including quality control. In the early to mid-1990s Nissan had efficient engines, and reliable drivetrains in well-assembled, fairly durable vehicles. They can do it again, but the Japanese government will have to help Nissan extricate itself from the "Alliance". It's too bad Japan didn't have a George Washington to warn about entangling alliances!

- Slavuta Nissan + profitability = cheap crap

- ToolGuy Why would they change the grille?

- Oberkanone Nissan proved it can skillfully put new frosting on an old cake with Frontier and Z. Yet, Nissan dealers are so broken they are not good at selling the Frontier. Z production is so minimal I've yet to see one. Could Nissan boost sales? Sure. I've heard Nissan plans to regain share at the low end of the market. Kicks, Versa and lower priced trims of their mainstream SUV's. I just don't see dealerships being motivated to support this effort. Nissan is just about as exciting and compelling as a CVT.

- ToolGuy Anyone who knows, is this the (preliminary) work of the Ford Skunk Works?

Comments

Join the conversation

Europe is already out of the recession, right? At least continental Europe anyway, I think the UK is still in it. We may have have just gotten out but it's a big question mark and won't know for a few months.