Quote Of The Day: There Are Incentives And Then There Are Incentives Edition

The big blockbuster, peanut-butter-approach programs like zero-percent financing and employee discounts for everyone have all been done before

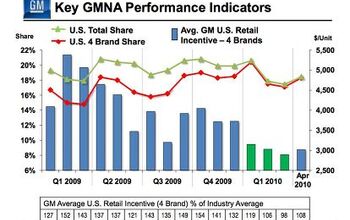

GM spokesman John McDonald in a Bloomberg story on the industry-wide drop in incentives and rising transaction prices. What about Truck Month? Surely we can all agree that has been “done before.” And though the Detroit automakers have eased incentives by about 25 percent from their March peak, at $3,278 this August, they’re still higher than the industry-average of $2,474. And the brief respite from incentive-redlining could be ending soon. With inventories depleted by Cash For Clunkers, GM is adding shifts in hopes of increasing production by 20 percent in the fourth quarter. Throwing more cars into a clunker-hangover sales environment could be just the thing to bring incentives and “peanut-butter-approach programs” (can anyone explain that pejorative?) back in a big way. But don’t call it a comeback: they never really left.

More by Edward Niedermeyer

Comments

Join the conversation

The need to offer incentives is a tacit understanding that their prices are too high for the market. If their prices were not too high they wouldn't need taxpayer bailouts, whether in the form of direct payments (oh, sorry, "loans"), seizing capital from bondholders, or not-cash for clunkers bailouts. Their too-high prices are being propped up by one gimmick or another, so that the taxpayer overpays not only when buying the product, but in paying taxes and taking on debt for his kids and grandkids. And I should feel bad when they have to offer their meager incentives, little changed in actual value over the last decade, while their MSRP prices are rising, several times over the last year, and again as I type?

Maybe there's another dimension to incentives... they can be used as a "down payment" in many cases. The finance company doesn't write a loan for more than the "price" of the car and everybody's satisfied and the books look OK but, in reality, it's a low-quality loan and the buyer is fully upside down. Too many low-quality loans will wreck a company. Incentives may be the only way that certain consumers can afford a new car and perhaps help create an unsustainable market.

CyCarConsulting: "With the dealers lean on inventory, GM could ease back into it very methodically, without devaluing the product once again." Are the dealers "lean on inventory?" The Camry outsells the Malibu by at least 2 to 1 (3 to 1 during August C4C Madness), yet Malibus, for example, in local inventories seem to outnumber Camrys by 1.5 to 1.