GM IPO: A Chinese Revolution?

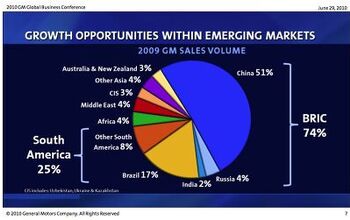

When Fritz Henderson rosily predicted that GM’s IPO would help pay off taxpayer loans “faster than people think,” our primary diagnosis was delusion. And how could you blame us? GM’s challenged relationship with reality is long and well-documented. Plus, GM executives are currently the only sources of optimism about their IPO. But perhaps there’s something other than PR prerogative underlying GM’s “little engine that could” affirmations. If something does lie beneath, it could be that GM’s Chinese partners are standing by to boost the IPO. TradingMarkets reports that sources inside SAIC say the longtime GM partner (and China’s largest domestic) could inject as much as ten billion yuan (slightly less than $150m) into GM’s IPO. That’s much, much less than GM will need to pay back a meaningful portion of its taxpayer debt, but it’s still a glimmer of hope. Sort of. But Chinese firms are not considering buying into GM because they’re so impressed with GM’s sales or market share. Well, not in the US anyway. This is would be a long-term strategic play, and one that could strike at the heart of GM’s alleged “American” identity. But as TTAC pointed out throughout the bailout proceedings, GM has been wagged by its Chinese tail for a while. After all, why else is Buick still around?

More by Edward Niedermeyer

Comments

Join the conversation

Have RMB climbed that much in value? When I was there it was about 7.5/1. 150 million USD would be about a billion yuan (plus change).

The plan is for the Chinese to eventually by GM and then sell the cars back to us through Wal Marts, just like they have with every other industry they've taken away. Maybe reconsider the IPO's

Makes sense to me. China potentially has 10 times the size of market as the US (by population). When GM started manufacturing engines in China and importing back to N. America, it did occur to me that GM's profits will, in the future, be from China and not the US. Just think, if GM gets 10% market share in China, that alone is the size of the entire US market. I think if GM were to expand further into China, they would have to also invest more in China and allow more Chinese investment into GM. If you are bullish about GM, you would buy GM stock. Maybe if one could buy GM stock only in China, that might be a decent investment risk.

I may purchase some of this. They have dumped their costs onto the taxpayer, scooped up a tax benefit with a current value of about 25% of the company and quality is improving somewhat. When- not if- the auto market improves they will do quite well.