E85 Boondoggle of the Day: Where There's a Will . . .

The issue is whether the proper development of an advanced biofuel industry in the United States is feasible when: (a) independent ethanol producers in the U.S. are at the mercy of volatile commodities markets for feedstock; and (b) the price of ethanol is controlled by the oil companies.

Commodity Market Volatility

While increased ethanol production is partially responsible for the increase in corn prices, the main driving factors in the run-up in corn prices are: rising demand for processed foods and meat in emerging markets such as China and India, droughts and adverse weather around the world, a decrease in the responsiveness of consumers to price increases, export restrictions by many exporting countries to reduce domestic food price inflation, the declining value of the dollar, skyrocketing oil prices, and commodity market speculation.

It is important to note that excessive speculation is not necessarily driving corn prices above fundamental values. Speculation can only be considered “excessive” relative to the level of hedging activity in the market.

The government’s announcement that it would resurvey corn acreage in several U.S. states launched a rally in Chicago Board of Trade corn on July 23, 2009, giving life to a market that appeared to be sinking toward $3 a bushel. September corn ended up 19 cents to $3.27 a bushel and December corn ended up 19 1/2 cents to $3.38 3/4 a bushel. Traders see the market moving toward the $3.50-$3.75 a bushel range in the December contract. Ethanol futures were also higher. August ethanol ended up $0.065 to $1.597 a gallon and September ethanol ended up $0.064 to $1.555.

Dr. David J. Peters, Assistant Professor of Sociology – College of Agriculture and Life Sciences at Iowa State University, has developed a calculator to determine the long-term economic viability of proposed ethanol plants. Dr. Peters was surprised to learn how sensitive the bottom line is to small changes in corn and ethanol prices.

According to Dr. Peters, a typical 100 MGY corn ethanol plant built in 2005 (financing 60 percent of its capital costs at 8 percent interest per annum for 10 years, with debt and depreciation costs of $0.20 per gallon of ethanol produced, and labor and taxes at a cost of $0.06 per gallon) will lose money in the current market:

At $3.25 corn, the ethanol break even price is $1.76 per gallon.

Oil Company Monopoly

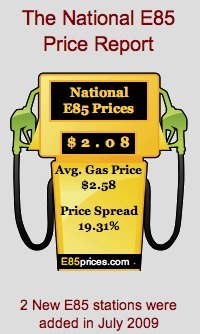

Only 2,175 of the 161,768 retail gasoline stations in the United States (1.3%) offer E85. These E85 fueling stations are located primarily in the Midwest. According to the U.S. Department of Energy, each 2% increment of U.S. market share growth for E85 represents approximately 3 billion gallons per year of additional ethanol demand.

While alleging an oversupply of corn ethanol, U.S. oil companies, due to a loophole in the Caribbean Basin Initiative, are currently allowed to import thousands of barrels of advanced biofuel (“non-corn ethanol”) every month without having to pay the 54-cent-per-gallon tariff.

Oil companies, or affiliates of oil companies, currently have a monopoly on blending fuel ethanol with unblended gasoline. Many states, e.g., Florida, allow only oil companies and their affiliates to blend and receive the 45 cents-per-gallon blender’s tax credit.

This monopoly impairs fair and healthy competition in the marketing of ethanol blends. Independent U.S. ethanol producers have the legal right, and must be assured the availability of unblended gasoline, to blend fuel ethanol and unblended gasoline to receive the blender’s tax credit and be cost-competitive.

In short, independent U.S. ethanol producers do not have bargaining power on either end of the supply chain. Corn ethanol producers are price takers. A comprehensive advanced biofuel industry development initiative is required to disrupt the status quo and establish fair and healthy competition in the marketing of advanced biofuel blends in our nation.

The Louisiana Solution

It is the cost of the feedstock which ultimately determines the economic feasibility of an ethanol processing facility. “Field-to-Pump” does not allow an advanced biofuel producer to fall victim to rising feedstock costs. Non-corn feedstock is acquired under the terms of an agreement analogous to an oil & gas lease. It is not purchased as a commodity.

A link exists between the cost of feedstock and ethanol market conditions. Farmers/landowners receive a lease payment for their acreage and a royalty payment based on a percentage of the gross revenue generated from the sale of advanced biofuel. “Field-to-Pump” marks the first time that farmers/landowners share risk-free in the profits realized from the sale of value-added products made from their crops.

Smaller is better. “Field-to-Pump” establishes the first commercially viable large-scale decentralized network of small advanced biofuel manufacturing facilities (“SABMFs”) in the United States capable of operating 210 days out of the year. Each SABMF has a production capacity of 5 MGY.

As with most industrial processes, large ethanol plants typically enjoy better process efficiencies and economies of scale when compared to smaller plants. However, large ethanol plants face greater supply risk than smaller plants. Each SABMF utilizes feedstock from acreage adjacent to the facility. The distributed nature of a SABMF network reduces feedstock supply risk, does not burden local water supplies and provides broad-based economic development. The sweet sorghum bagasse is used for the production of steam. Vinasse, the left over liquid after alcohol is removed, contains nutrients such as nitrogen, potash, phosphate, sucrose, and yeast. The vinasse is applied to the sweet sorghum acreage as a fertilizer.

Act 382 focuses on growing ethanol demand beyond the 10% blend market. Each SABMF produces advanced biofuel, transports the advanced biofuel by tanker trucks to its storage tanks at its local gas stations and, via blending pumps, blends the advanced biofuel with unblended gasoline to offer its customers a choice of E10, E20, E30 and E85. Each SABMF captures the blender’s tax credit of 45-cents-per-gallon to guarantee sufficient royalty payments to its farmers/landowners and be cost-competitive.

In the U.S., the primary method for blending ethanol into gasoline is splash blending. The ethanol is “splashed” into the gasoline either in a tanker truck or sometimes into a storage tank of a retail station. The inaccuracy and manipulation of splash blending may be eliminated by precisely blending the advanced biofuel and unblended gasoline at the point of consumption, i.e., the point where the consumer puts E10, E20, E30 or E85 into his or her vehicle.

A variable blending pump ensures the consumer that E10 means the fuel entering the fuel tank of the consumer’s vehicle is 10 percent ethanol (rather than the current arbitrary range of 4 percent ethanol to at least 24% ethanol that the splash blending method provides) and 90% gasoline. Moreover, a recent study, co-sponsored by the U.S. Department of Energy and the American Coalition for Ethanol, found E20 and E30 ethanol blends outperform unleaded gasoline in fuel economy tests for certain motor vehicles.

Hydrous advanced biofuel, which eliminates the need for the costly hydrous-to-anhydrous dehydration processing step, results in an energy savings of 35% during processing, a 4% product volume increase, higher mileage per gallon, a cleaner engine interior, and a reduction in greenhouse gas emissions.

On February 24, 2009, the U.S. EPA granted a first-of-its-kind waiver for the purpose of testing hydrous E10, E20, E30 & E85 ethanol blends in non-flex-fuel vehicles and flex-fuel vehicles in Louisiana. Under the test program, variable blending pumps, not splash blending, will be used to precisely dispense hydrous ethanol blends of E10, E20, E30, and E85 to test vehicles for the purpose of testing for blend optimization with respect to fuel economy, engine emissions, and vehicle drivability.

The Louisiana Department of Agriculture & Forestry Division of Weights and Measures will conduct the vehicle drivability phase of the test program. Fuel economy and engine emissions testing will be conducted by Louisiana State University in Baton Rouge, Louisiana. Sixty vehicles will be involved in the test program which will last for a period of 15 months.

Louisiana Act 382 ensures: (a) ethanol producers in the U.S. are no longer at the mercy of volatile commodities markets for feedstock; (b) farmers/landowners share risk-free in the profits realized from the sale of value-added products made from their crops (c) the price of ethanol is no longer controlled by the oil companies; (d) feedstock supply risk, the burden on local water supplies, and the amount of energy necessary to process advanced biofuel are minimized; and (e) rural development and job creation are maximized.

Furthermore, due to the advantages of producing advanced biofuel from sweet sorghum juice, the use of sweet sorghum bagasse for the production of steam in the SABMF, and the energy savings of processing hydrous advanced biofuel, the Louisiana solution reduces field-to-wheel lifecycle GHG emissions by 100%.

Copyright © 2009, NewsBlaze, Republished on TTAC with the copyright owner’s permission.

Brian J. Donovan is the CEO of Renergie, Inc.

About Renergie [from the author]:

Renergie was formed on March 22, 2006 for the purpose of raising capital to develop, construct, own and operate a network of ten ethanol plants in the parishes of the State of Louisiana which were devastated by hurricanes Katrina and Rita. Renergie’s “ field-to-pump” strategy is to produce non-corn ethanol locally and directly market non-corn ethanol locally. On February 26, 2008, Renergie was one of 8 recipients, selected from 139 grant applicants, to share $12.5 million from the Florida Department of Environmental Protection’s Renewable Energy Technologies Grants Program. Renergie received $1,500,483 (partial funding) in grant money to design and build Florida’s first ethanol plant capable of producing fuel-grade ethanol solely from sweet sorghum juice. On April 2, 2008, Enterprise Florida, Inc., the state’s economic development organization, selected Renergie as one of Florida’s most innovative technology companies in the alternative energy sector.

More by Brian J. Donovan

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- David Murilee Martin, These Toyota Vans were absolute garbage. As the labor even basic service cost 400% as much as servicing a VW Vanagon or American minivan. A skilled Toyota tech would take about 2.5 hours just to change the air cleaner. Also they also broke often, as they overheated and warped the engine and boiled the automatic transmission...

- Marcr My wife and I mostly work from home (or use public transit), the kid is grown, and we no longer do road trips of more than 150 miles or so. Our one car mostly gets used for local errands and the occasional airport pickup. The first non-Tesla, non-Mini, non-Fiat, non-Kia/Hyundai, non-GM (I do have my biases) small fun-to-drive hatchback EV with 200+ mile range, instrument display behind the wheel where it belongs and actual knobs for oft-used functions for under $35K will get our money. What we really want is a proper 21st century equivalent of the original Honda Civic. The Volvo EX30 is close and may end up being the compromise choice.

- Mebgardner I test drove a 2023 2.5 Rav4 last year. I passed on it because it was a very noisy interior, and handled poorly on uneven pavement (filled potholes), which Tucson has many. Very little acoustic padding mean you talk loudly above 55 mph. The forums were also talking about how the roof leaks from not properly sealed roof rack holes, and door windows leaking into the lower door interior. I did not stick around to find out if all that was true. No talk about engine troubles though, this is new info to me.

- Dave Holzman '08 Civic (stick) that I bought used 1/31/12 with 35k on the clock. Now at 159k.It runs as nicely as it did when I bought it. I love the feel of the car. The most expensive replacement was the AC compressor, I think, but something to do with the AC that went at 80k and cost $1300 to replace. It's had more stuff replaced than I expected, but not enough to make me want to ditch a car that I truly enjoy driving.

- ToolGuy Let's review: I am a poor unsuccessful loser. Any car company which introduced an EV which I could afford would earn my contempt. Of course I would buy it, but I wouldn't respect them. 😉

Comments

Join the conversation

agenthex: I am going with wsn on this one, especially since you noted last night that: "The “problem” is mostly a long term one revolving around _SLOWLY BUT STEADILY INCREASING_ energy costs when your economics game assumes low costs." In situations where the value of the specific product changes slowly (ie., the product just suddenly doesn't become available), I think market forces will easily work. I also think a quick change on fuel would quickly force reconsideration as well. It's one of those things that's important, and market forces tend to choose well. A cablecard is just a obsolete piece of technology designed to keep you in front of the tube (or LCD as it were) flipping channels. What's worse about cablecards, is even though it is a standard, you NEVER buy a cable card from one place, and use it in another. I mean, in theory, sure it will work. But from the research I did on the net a few weeks ago, most cable companies will not activate a "wild" cable card on their own network. Oil selected itself, and once it is gone or too expensive to purchase, alternatives will become reality. I don't/won't believe for a second that something as complex as energy is best planned by a central planning authority. Central authorities work fine for very short emergency situations, where the operational parameters are well defined. But anything much longer than a few years, and the authority ingrains itself into the system, such that the system cannot survive without it. Best not to refer to a central planner on something like energy, or mark my words: you will eventually regret it.