Editorial: GM Chapter 7?

The most definitive difference between Chrysler’s swift conversion from Old to New Chrysler and the General’s “reinvention”: the element of surprise. Or lack thereof. The General’s list of creditors on GM’s court filing (dealers, parts manufactures, advertising media, bondholders, et al.) are all painfully aware of what happens when “The Fix” is in. They now know what it means when The President of the United States promises the public that “we will get this done in a swift and expeditious manner.” Forewarned is forearmed. And there’s another crucial difference between Fiatsler’s transformation and the plans for Government Motors: the GM dealer body is a wealthier, more connected group of businessmen than the Chrysler dealer body. In other words, “Old” GM may not go so quietly into that good night.

While much has been made about GM’s financial face plant, the automaker’s dealer body as a whole has enjoyed decades of immense profits, largely on the back of Suburbans, Tahoes and Silverados. The GMT900 SUV platform wasn’t enough to save the corporate mothership, but it’s been a profit center to the GM dealer that the public cannot even begin to fathom.

When the new Suburban was introduced in 1992, the majority of the metro GM dealers retailed the product for up to $3,000 over MSRP. For several months. The Y2K Suburbans and Tahoes were sticker plus units. I recall buying three new Suburbans from Troy Aikman Chevrolet for full MSRP, titling them on my dealer license and selling them to dealers that same week at the Dallas Auto Auction for $1,500 over MSRP. When the supply caught the demand curve, dealers discounted the model—all the way down to full MSRP. Dealers still made thousands of dollars per unit.

The same story unfolded for the Suburban’s horizontally-challenged little brothers (Tahoe/Yukon). The truck trough didn’t dry up even (especially?) when GM built a $75,000 Suburban called Escalade EXT. The Suburbans delivered huge profits to dealers all through the ’90s, into the next century. Same story for GM’s pickup trucks, only more so. If the gas price shock hadn’t happened, if the economy was still relatively robust, a GM franchise would still be a license to print money. Why do you think there were so many of them?

Up until the crash, GM dealers amassed huge fortunes. They used this money to gain tremendous political power, on every level (local, country, state and federal). As TTAC points out, car dealer cash fueled the political ambitions of presidential aspirant and current Secretary of State Hillary Clinton. Some dealers, being dealers, pissed-away their money. Others, many of whom recently received their walking papers from GM, have a significant war chest and an embarrassment of riches stashed in the political favor bank. As you can imagine, they’re not afraid to use either.

GM dealers witnessed the shellacking that Chrysler dealers just received. Even the ones that survived the recent dealer cull know that their time may be at hand. The Chrysler dealers took a few swings at the Obama politico machine but did not have the raw muscle to connect their punch. Take it from me, the GM dealer body is tooled-up, ready for a brawl.

Chrysler was “sold” to Fiat, the UAW and American taxpayers. There is no “buyer” for GM other than the feds. It’s just a default with a forgiveness. This would be a realistic strategy—if The General was not disowning a large percentage of its dealer body during this transition. But they are. Which puts the company’s new owners, politicians, straight in the middle of the dealers’ crosshairs.

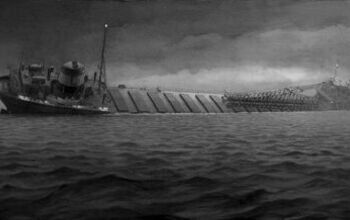

The General’s bankruptcy will get hamstrung in court. The National Automotive Dealers Association and state dealer associations are going to have more success wrestling this bear back into its cage than we saw with Chrysler. GM’s C11 is in real danger of becoming so convoluted with legitimate legal concerns that the bankruptcy will end up converting to a Chapter 7 liquidation. The brands and assets will be carved out into packages and sold to the top dollar suitors.

The news story of the future is not which dealer was terminated but that all dealers are suspended until the liquidation sales have commenced. Dealers will put on their best-pressed suits to court the new owners of their family heirloom name plates, while rapidly encouraging them to become their districts’ new Chevrolet, Cadillac, Buick, Hummer, and possibly even Pontiac dealers, just as many of their grandfathers and great grandfathers did in the middle of the twentieth century.

Either that or The Presidential Task Force of Automobiles will dip into the public purse once again and arrange enormous payouts to abandoned dealers. After all, politicians can resist anything except political pressure. But any such payoffs will worsen GM’s reputation as a welfare queen, and sour voters to the whole project. No matter how you look at it, this dog won’t hunt.

More by Jehovah Johnson

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff I doubt most people care. Care more about their vehicles but after being a loyal gm customer for almost 50 years and having family members all the way back to my grandparents I no longer care. The last gm vehicle I owned was 2 years ago. To me gm can go into the dustbin of history.

- Cprescott I'm surprised they didn't move to China. That is who bankrolled their bankruptcy bailout plan.

- Analoggrotto You ask as if I should care. Well I don't. Any more questions?

- Analoggrotto What the heck are those people doing in front of that house? Just staring at this stupid pos truck?

- Jeff Good review but the XLT although not a luxury interior is still a nice place to be. The seats are comfortable and there is plenty of headroom. The main downside is the limited availability resulting in dealer markups above MSRP. I have a 2022 hybrid Maverick XLT for over 2 years and it has more than met my expectations. I believe for many who do not need a truck most of the time but want one the Maverick will meet most of their needs.

Comments

Join the conversation

....or not.....