Old Muscle Car Bubble About to Burst

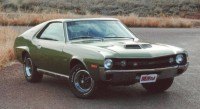

With the economic downturn, recession, depression, or whatever you want to call it, we already know that new car sales are taking a long vacation from existence. And cars like the Ferraris and Alfa 8Cs of the world shouldn’t have too much trouble selling, since there are still millions of millionaires. But how about the muscle cars? By and large, the boom in muscle car prices was the result of nostalgic shoppers, laying out significant – but not exorbitant – sums for the dreamcars of their youths. We’re talking about people that had been buying and selling drivable muscle cars in the $20k to $50k range, not just the Barret-Jackson shopping insanity. With financial “gurus” like Jim Cramer telling punters to cash-out all their investments, we can expect a glut of reasonable condition cars on the market, as folks look to pick up more money before the storm. And then consider that in the context of a hugely reduced buyers’ market: how many people are looking for five-figure toys these days? I’m far from an expert, but I’d guess we will see something on the order of a 60 percent drop in the market values of cars like Camaros, Mustangs, Chevelles, and Pontiacs. The rarer and collectible models will no doubt fare better, as these tend to go to buyers that do more polishing and less driving (if ever). While some sellers may decide to hang on to their cars because there are so few buyers, there will still be plenty of cars on the market. It’s a buyer’s opportunity, no doubt about that. If, like me, you’ve ever just wanted an AMC AMX in the driveway, the next few years might be the time, should you be employed.

Comments

Join the conversation

What people forget is that Europeans and the Asians love old American cars, too. I work at the Carlisle Events shows, and attend the big Antique Automobile Club of America (AACA) meet in Hershey (the 2008 meet is this weekend) every years. Plenty of foreigners are eager to snap up old American iron (which makes me chuckle at the posters here who look down upon 1950s and 1960s Detroit iron as crude and unsophisticated compared to those "superior" foreign cars - someone needs to tell this to the Europeans eagerly paying good money for old American cars). Even if more Americans can't afford these cars, or are forced to sell because of economic reverses, there is still a very big overseas market for these cars. So don't think that you will be getting that mint 1970 Plymouth Road Runner with the 440 Six-Pack for about $15,000 any time soon...

While somewhat depressing, I can see a positve side to this. I tend to prefer cars from the 1980's/Early 1990's, and they are already worthless as it is, which means they will even depreicate furhter. I can wait for my 5000$ 930!

Justin, The expensive toy market is in terrible shape. I can't get anywhere near the price for my airplane that I would have a couple years ago, and planes over four years old have traditionally appreciated. (I say 2 years ago because threatened FAA fee changes along with fuel and income tax rule changes actually gave us a whack even before this downturn.) I say we toy owners need a bailout from Washington. Hell, the light plane manufacturers have started layoffs already. This is about jobs! If recreational luxuries like collectible cars, nice boats, and light aircraft become worthless the owners won't be buying anymore upgrades or trading up. There will be LOTS of closed businesses and thousands of lost jobs. Ya, where da hell is OUR bail out! \sarcasm