Oil Prices

Halleluiah! Oil prices are falling. Despite Nigerian revolutionaries attacking Royal Dutch Shell facilities. Despite hurricanes Gustav and Ike disrupting gulf production. And despite all of the hysteria of the last six months trumpeting the end of the era of cheap oil, oil prices have fallen as much as $55 per barrel after being pushed to a peak of $147.27 in July. Once the residual shock to gasoline refining by Ike dissipates over the next couple of weeks, consumers will begin to see a substantial difference at the pump. So is it safe for Americans to recommission their mothballed SUVs and muscle cars? A close look at financial events in recent days indicates otherwise.

First, let’s recap what we’ve seen.

Beginning in 2004 the price of Light Sweet Crude on NYMEX began an almost uninterrupted ascent that added more than $100 to the price of every barrel. A circus ensued. Consumers swooned (precipitously). Automakers faltered (dangerously). Speculators hyped (aggressively). News media sensationalized (despicably). Inflation grew (corrosively). Environmentalists cheered (quietly). Politicians protested (hypocritically). Oil company execs defended (piously). Saudi’s pumped (merrily). Oil peaked (allegedly). Demand evaporated (predictably). Prices fell.

A more revealing analysis shows that the surge in prices was the result of two seldom mentioned factors: a weakening dollar that required that Americans spend more of them to get their fix of black gold. And index fund managers discovered that the commodities market was a good place to shelter their money from falling real estate and stock markets. In May, BusinessWeek summed the market distortion this way:

“[Commodities] are experiencing demand shock from a new category of speculators: institutional investors like corporate and government pension funds, university endowments, and sovereign wealth funds,” said Michael Masters, managing member of Masters Capital Management, a Virgin Islands-based hedge fund.“Index speculators are the primary cause of the recent price spikes in commodities.

Speculative activity in commodity markets has grown dramatically over the last several years. In the past decade, the share of long interests – positions that benefit when prices rise – held by financial speculators has grown from one-quarter to two-thirds of the commodity market. In only five years, from 2003 to 2008, investment in index funds tied to commodities has grown twentyfold, from $13 billion to $260 billion.

Additionally, hedge fund director Masters points to data showing that over a five-year period, China’s demand for oil has increased by 920 million barrels, while over the same period, index speculators’ demand has increased by 848 million barrels.”

Whew! So it is safe to say that if you are invested in any of these index funds or if you are due a pension, you likely benefited from the higher commodity prices at the same time you are paying higher prices at the pump.

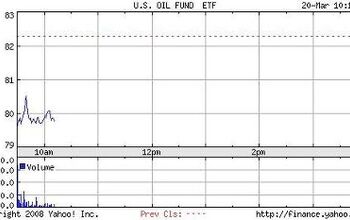

Since that time, we have seen the market peak followed by a rapid deflation in prices. While it can be argued that demand destruction accounts for some of the effect, it alone cannot approach the 37% fall in price. Rather, the dollar has strengthened (erratically) and investors have stampeded out of the notoriously risky commodities market.

This is good news, right? The bubble, which energy economist Edward Morse calls it the “Oil Dot-com,” has burst. Now consumer prices can be restored to normal supply and demand price points. Yes, but… (There’s always a big but and I cannot lie.)

Monday morning financial markets were ambushed by the announcement that troubled investment bank Lehman Brothers, a 158-year old fixture on Wall Street, has folded. The big B-K. Horrified, the Dow Jones industrials plummeted more than 500 points, the worst day of trading since terrorists slammed hijacked airliners into the World Trade Center.

What of oil futures? Based on recent history one would think that fleeing investors would seek refuge for their money back in the commodities market. Didn’t happen. Instead it followed the trend of the broader market. The inverse relationship between the markets appears to have broken. Which is a good thing – I would rather index fund managers look elsewhere when stocks falter so energy prices that directly impact my pocketbook don’t become unnaturally inflated.

But this is a dire indicator. Rather than the correction of an over-inflated price (I still believe that oil is overpriced and has room to fall further before it achieves an undistorted equilibrium price), this week’s decline shows that investors well and truly have lost faith in the economy. Rather than divert their funds to alternate investments they sold off for cash or stayed pat and suffered a loss in equity.

In other words, factories will idle, business will stop growing, and the transport of goods will slow because no one is buying. All of this points towards corporate downsizing and layoffs.

B&B, be advised: keep your gas guzzlers parked. It’s going to get worse before things start to get better.

More by William C Montgomery

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Nobody here seems to acknowledge that there are multiple use cases for cars.Some people spend all their time driving all over the country and need every mile and minute of time savings. ICE cars are better for them right now.Some people only drive locally and fly when they travel. For them, there's probably a range number that works, and they don't really need more. For the uses for which we use our EV, that would be around 150 miles. The other thing about a low range requirement is it can make 120V charging viable. If you don't drive more than an average of about 40 miles/day, you can probably get enough electrons through a wall outlet. We spent over two years charging our Bolt only through 120V, while our house was getting rebuilt, and never had an issue.Those are extremes. There are all sorts of use cases in between, which probably represent the majority of drivers. For some users, what's needed is more range. But I think for most users, what's needed is better charging. Retrofit apartment garages like Tim's with 240V outlets at every spot. Install more L3 chargers in supermarket parking lots and alongside gas stations. Make chargers that work like Tesla Superchargers as ubiquitous as gas stations, and EV charging will not be an issue for most users.

- MaintenanceCosts I don't have an opinion on whether any one plant unionizing is the right answer, but the employees sure need to have the right to organize. Unions or the credible threat of unionization are the only thing, history has proven, that can keep employers honest. Without it, we've seen over and over, the employers have complete power over the workers and feel free to exploit the workers however they see fit. (And don't tell me "oh, the workers can just leave" - in an oligopolistic industry, working conditions quickly converge, and there's not another employer right around the corner.)

- Kjhkjlhkjhkljh kljhjkhjklhkjh [h3]Wake me up when it is a 1989 635Csi with a M88/3[/h3]

- BrandX "I can charge using the 240V outlets, sure, but it’s slow."No it's not. That's what all home chargers use - 240V.

- Jalop1991 does the odometer represent itself in an analog fashion? Will the numbers roll slowly and stop wherever, or do they just blink to the next number like any old boring modern car?

!["The Saudis Are Concerned That Today's Record [oil] Prices Might Eventually Damp Economic Growth and Lead to Lower Oil Demand"](https://cdn-fastly.thetruthaboutcars.com/media/2022/07/20/9494830/the-saudis-are-concerned-that-today-s-record-oil-prices-might-eventually-damp.jpg?size=350x220)

Comments

Join the conversation

PCH101: Oil companies didn't accept anything, they were not in a position control the price in the 1990s. The 1990s are the darkest time in history as far as oil companies are concerned, they saw their profits strangled by Clinton era oversight that kept them from doing what they are doing now. I'm not going to say it again, the consolidated their monopoly AFTER Bush took office. AFTER he removed price controls, AFTER he told the FTC to stop looking at them. http://www.wtrg.com/oil_graphs/oilprice1970.gif You don't find that graph the least bit fishy?

Pch101: By the way, the $150/barrel price that traders loved, well only traders who bought in when it was low loved that. It does nobody any good if the price is stable. It will be $150 again soon, you can bet on it, and it will be the oil companies themselves that trigger it, NOT the traders.