GM Loses $15.5b in Q2

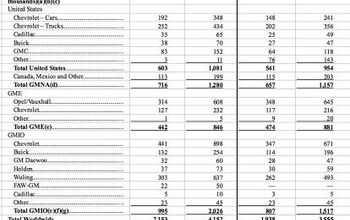

That's a lot of billions. Of course, GM camp followers will do the usual math, discounting "one time" charges to paint a more palatable picture of pissed-away profits. The New York Times does the math for those so inclined. "According to the earnings statement, the loss included $9.1 billion in one-time charges, $3.3 billion of which was for employee buyouts… Included in the results, the statement said, was $1.3 billion in write-offs that reflect the drop in value of trucks and sport utility vehicles in GMAC Financial Services’ portfolio… Excluding one-time charges, G.M. had a loss of $6.3 billion or $11.21 a share, compared with income of $1.3 billion or $2.29 a share in the same period last year." And still the spin is spun. "We have the right plan for G.M., driven by great products, building strong brands, fuel-economy technology leadership and taking full advantage of global growth opportunities," GM CEO Rick Wagoner asserted. His optimism is based on this startling stat: "North American sales were down 20 percent, or 236,000 units, while sales outside of North America grew by 10 percent or 116,000 units. A record 65 percent of G.M.’s sales for the second quarter were outside the United States, the company said, while global market share was 12.3 percent, down 0.9 percent because of the weakness in North America." GM Death Watch later today.

More by Robert Farago

Comments

Join the conversation

I feel sorry for the dealers, sort of. They have little say in the product. If I had a dealership and was ready to retire and sell it, the price that I receive for all the years building it is now much lower than it would have been many years back.

It's not really about the money. If GM doesn't have a competitive product that people want to buy and doesn't straighten out their manufacturing production to match their sales they are toast.(they are) To keep paying the huge legacy costs to the retirees and running the uneeded plants producing unwanted product is a quick route to CH11. I think they have already starting the plan forward for CH11 as they realize there is no other way. Shed all those retiree's cost and they are back in business.

What happens if the supplier files for bankruptcy? Can their judge get them out of the contracts forced on them by GM's judge? Just how silly-or frightening-is this?