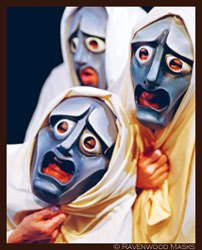

General Motors Death Watch 22: If the Mask Fits…

GM's second quarter financial results prove what we've been saying all along: sales do not necessarily equal profits. Thanks to its Employee Discount for All program, The General's turnover climbed by a staggering 47%. The automaker's US market share rose to 30%. And yet GM lost another $1.2b, which is nearasdammit the same amount they lost last quarter. Add up cash reserves, marketable securities and available assets (from an employees' healthcare trust no less) and The General has about $20.2 billion in the bank. Simple math says that GM's US division will be completely bankrupt in a little over four years.

Of course, that assumes a steady burn rate. It's entirely possible that the automaker's fire sale has sucked-up most of the cash from GM's customer base, leaving a diminished market for new products. These new whips will have to kick some major league ass (i.e. Toyota et al) to stave off an even more precipitous earnings slide. And again, that's income. GM's expenditure is still wildly out of control; despite Rabid Rick Wagoner's public pledge to hold the union's feet to the fire on health care benefits, he, um, hasn't. There's no word about containing equally onerous (though less publicized) production, labor, management, administrative, inventory, distribution and marketing costs.

At some point, the situation will reach a tipping point, where everyone from suppliers to politicians will realize that the Titanic isn't going to make it. The words coming from the Chief Financial Officer's poop deck are hardly what you'd call reassuring: 'We have not put targets and we've not put dates on a North American recovery plan, but believe us, we have those targets internally.' So that's alright then. If the lifeboat known as GMAC finance is sold, you can expect the resulting panic to greatly accelerate the main company's demise.

But even if GM's profitable divisions are retained until the very last, it's highly unlikely that GM shareholders will simply stand by and watch the world's largest automaker slip into Chapter 11. When the ship's lights start flickering, Wagoner, Lutz, LaNeve and the rest of the current crew will be cast adrift. Divisions will be shuttered, plants terminated, product lines scuttled, unions confronted, assets sold. In fact, the rescue plan will be pretty much what it should have been five years ago. While you can't blame a Neanderthal for not winning a MacArthur genius award, watching this once proud company creaking and groaning towards a watery grave is as depressing as it is predictable.

The GM story has all the inevitability of a Greek tragedy. While the ending is never in doubt, the tale's twists and turns are endlessly fascinating. Consider Pontiac. While other GM brands managed to (at least) clear out lots of unsold inventory, and some even gained traction (Hummer sales up by over 200%), the Chief's sales were down 14.1%. Meanwhile, Pontiac's secret weapon is stuck in the lab. When the division recently announced that the Solstice would appear in showrooms this August, beleaguered front liners shouted huzzah! Yes but… actual, honest-to-God customer deliveries are still delayed until fall. Oh well.

Pontiac's misfires are yet more proof of the axiom that character is plot. The reason that Pontiac is a dead brand waiting is that it's just one facet of a corporation suffering from multiple personality disorder. In other words, there is no way on God's green earth that GM can make eight– count'em: eight– carmaking divisions fire on all cylinders all at the same time. Even if one or two members of GM's portfolio suddenly become wildly successful– a fair proposition given the law of averages– the others will take the resources generated and piss them away. There will always be a crisis somewhere in The General's ranks. It's a no-win situation.

Need proof? Look overseas. GM's European operations posted a $37m profit. It's not great, but a profit beats a loss every time. So why is GM Europe floating while its US parent flounders? European labor costs are worse than America's, and governmental taxation and regulation is on the far side of burdensome. But GM Europe doesn't sell eight different brands. Vauxhall [UK] is a single strong brand with a coherent message and worthy products. Ditto Opel on the Continent. These companies have focus.

Of course, that's changing. Chevrolet/Daewoo is planning a major European expansion, Cadillac wants to play on the world stage, Saab fancies its chances and… The trick to avoiding tragedy is to be the master of your own character. Clearly, GM is hamstrung by its hubris, and, ultimately, defeated by self-denial.

More by Robert Farago

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff Not bad just oil changes and tire rotations. Most of the recalls on my Maverick have been fixed with programming. Did have to buy 1 new tire for my Maverick got a nail in the sidewall.

- Carson D Some of my friends used to drive Tacomas. They bought them new about fifteen years ago, and they kept them for at least a decade. While it is true that they replaced their Tacomas with full-sized pickups that cost a fair amount of money, I don't think they'd have been Tacoma buyers in 2008 if a well-equipped 4x4 Tacoma cost the equivalent of $65K today. Call it a theory.

- Eliyahu A fine sedan made even nicer with the turbo. Honda could take a lesson in seat comfort.

- MaintenanceCosts Seems like a good way to combine the worst attributes of a roadster and a body-on-frame truck. But an LS always sounds nice.

- MRF 95 T-Bird I recently saw, in Florida no less an SSR parked in someone’s driveway next to a Cadillac XLR. All that was needed to complete the Lutz era retractable roof trifecta was a Pontiac G6 retractable. I’ve had a soft spot for these an other retro styled vehicles of the era but did Lutz really have to drop the Camaro and Firebird for the SSR halo vehicle?

Comments

Join the conversation